Uber is still trying to put itself in a better place as the company is unable to comply with the European Union’s algorithmic transparency requirements. The issue was aggravated when two drivers complained of terminating their account by an automated flag of Uber’s algorithm. The company also failed to convince the court about a daily fine policy capped at €4,000.

Uber Stock Price Prediction 2030, FTX currently stands at $31.93 USD with a market capitalization of $0, making it rank 4735 in the most valuable coins list. UBER has a 24-hour volume of $17,318, according to TechNewsLeader Price Index.

Uber

Uber is a transportation company with an app that allows passengers to hail a ride and drivers to charge fares and get paid. More specifically, Uber is a ridesharing company that hires independent contractors as drivers.

Overview

It’s one of many services today that contribute to the sharing economy, supplying a means of connecting existing resources instead of providing the physical resources themselves. The company was founded by Travis Kalanick and Garrett Camp in 2009 and is headquartered in San Francisco. The company has an estimated 110 million users worldwide.

Work

Uber links passengers with drivers using the Uber app. Generally, the drivers own their own car. The company also offers rental or lease on cars through third-party partners like Hertz, Get Around, and Fair. UberFleet is an app for those managing squads of drivers. Uber offers rides under a dynamic pricing model for both drivers and passengers.

Passengers needing a ride can use the app to hail a driver with an estimated price that is dependent on the destination as well as the demand at the time. Uber incentivizes drivers to pick up more fares in peak busy hours by paying more during those times. This means that riders are charged more at busy times in order to help ensure the needed number of drivers are available.

Berkshire Hathaway Inc. (Brkb Stock Price) vs. Uber Technology Inc.: Buffett’s Berkshire Hathaway (Brkb Stock Price) considered providing a convertible loan to Uber that would have protected Buffett’s investment should the Silicon Valley ride-hailing company hit a financial crisis, the report said.

Benefits

Using a ridesharing app like Uber has several advantages over more traditional transportation methods. As mentioned, Uber’s dynamic pricing model attracts drivers to certain areas at critical times, making it more likely that a car will be available during times of high passenger need.

Uber’s app also lets users see a map that displays all the potential drivers in the area. Once a driver has been chosen, the passenger can watch their driver navigate to the pick-up location in real-time, with updates on the estimated time of arrival. This allows for ultimate convenience when coordinating a ride.

From a broader perspective, Uber shares a benefit with other components of the sharing economy. This benefit is that companies that follow a sharing model are theoretically able to more efficiently use underutilized assets such as tools, clothing, houses, and in Uber’s case, cars.

Challenges

Although Uber generally increases the convenience and efficiency of ridesharing using its app, there are ways in which this method of offering and getting rides can create new challenges for passengers and drivers alike. Because the company manages employment and facilitates rides remotely, it’s nearly impossible for the company to adequately handle incidents over such a large breadth of contexts and interactions.

In addition, although Uber drivers must pass a background check to become a driver, it’s not perfect, and Uber does not independently test driver skills in the hiring process. This results in inconsistencies in driver quality, which leads to customer complaints and potentially a damaged reputation for Uber.

Importance

Uber is currently seen to take over 69% of the United States market share of consumer transport, and 25% of food delivery with its app Uber Eats. As of 2018, Uber is available in 700 cities and 63 countries and enlists an average of 50,000 new drivers monthly. As of 2019, there are approximately 4 million registered Uber drivers. Almost half of all registered Uber drivers have multiple jobs.

Uber Technologies Inc. vs. Meta Stock: Uber Technologies Inc. (UBER) shares a spot on IBD Leaderboard with Tesla (TSLA) and Meta Stock Price Prediction (META). Uber stock also joins Tesla and Meta in crafting new chart bases while navigating selling pressure in the market indexes.

Uber Technologies Inc.

Overview

Uber Technologies Inc. (Uber) is a provider of ride-hailing services. It offers services through its technology platforms such as mobile applications and websites. Uber connects riders with drivers or independent ride solution providers. The company offers pick-up and drop services at airports across continents.

The company, through its technology platform, provides food, meal, and grocery delivery services. Uber also offers freight and logistics services. It provides services to the corporate sector for a daily commute and connects consumers with public transportation networks. The company has operations in several cities across the Americas, Europe, the Middle East, Africa, and Asia-Pacific. Uber is headquartered in San Francisco, California, the US.

Barrick Gold Stock vs. Uber Technologies Inc.: Barrick Gold Stock purchased Goldstrike, which was a rapid success making Barrick one of the biggest gold mining companies globally compared to Uber Technologies Inc.

Uber Technologies Inc. (UBER) is best known for its ride-hailing service whose Uber app matches consumers looking for ride services. The company was founded in 2009 and reached 1 billion rides by 2015. Four years later, it went public in an IPO in May of 2019. The global COVID-19 pandemic has caused a drastic decline in Uber’s traditional ride service and its revenue.

Dara Khosrowshahi

Dara Khosrowshahi owns 913,505 shares of Uber, representing 0.05% of all outstanding shares. Khosrowshahi was appointed CEO of Uber in 2017, replacing Uber’s controversial founder and CEO, Travis Kalanick. In his new role as CEO, Khosrowshahi manages the company’s 22,000 employees.

Tony West

Tony West owns 189,032 shares of Uber, representing 0.01% of all outstanding shares. West is the chief legal officer, senior vice president, and corporate secretary of Uber, where he leads the Legal, Compliance Ethics, and Security teams. Previously, West was corporate secretary and executive vice president of public policy and government affairs of PepsiCo, Inc. (PEP).

Nelson J. Chai

Nelson J. Chai owns 180,528 shares of Uber, representing 0.01% of all outstanding shares.5 Chai is chief financial officer of Uber, having previously served as CEO of Warranty Group, an insurance and warranty provider. He has also been a president of CIT Group, chief financial officer of Merrill Lynch & Co., and has held executive leadership positions at NYSE Euronext and Archipelago Holdings.

Twitter Stock vs. Uber Technologies Inc.: Uber employs Facebook, Instagram, and Twitter as its main digital marketing channels. Facebook and Twitter Stock allow users to post positive and negative feedback, allowing Uber to be in direct contact with its customers. Instagram is where Uber unveils new features and offers exclusive deals and discounts.

Institutional investors hold the majority of Uber Shareholders’ shares at about 70.6% of total shares outstanding.

SB Investment Advisers (UK) Ltd.

SB Investment Advisers (UK) Ltd. owns 222.2 million shares of Uber, representing 12.6% of total shares outstanding, according to the company’s 13F filing for the period ending September 30, 2020. The company is a subsidiary of SoftBank Company, a Japanese strategic holding company investing in technology companies.

Morgan Stanley

Morgan Stanley owns 101.5 million shares of Uber, representing 5.8% of total shares outstanding, according to the company’s 13F filing for the period ending September 30, 2020.11 The company is a multinational financial services and investment firm whose offerings include mutual funds, ETFs, and related products.

FMR LLC

FMR LLC, which operates under the name Fidelity, owns 82.3 million shares of Uber, which represents 4.7% ownership of the total shares, according to the company’s 13F filing for the period ending December 31, 2020.17 Fidelity is a financial services firm that sells and operates a large number of ETFs and mutual funds, as well as offering brokerage and wealth management services. Fidelity had $3.8 trillion in assets under management as of December 2020.

The Stronger Competitive Moat: Airbnb Or Uber – Uber Stock and Airbnb Stock are two special companies: they were the first to massively disrupt the taxi and hotel businesses respectively, creating two-sided marketplaces that enjoy strong competitive advantages. Both companies are still growing quickly, but they are both very expensive, both in absolute terms and when compared to competitors. We believe Airbnb has a stronger competitive moat, which is reflected in its higher profit margins that rival those of software SaaS companies.

Uber: Advantages and Disadvantages

Bright-yellow taxicabs once dominated the streets of Manhattan. By 2020, there were four times as many ride-sharing vehicles on the streets as taxis. Those vehicles were summoned by apps offered not only by Uber and Lyft but by Via, Juno, and Gett.

Uber and its competitors such as Lyft have dramatically changed the personal transportation industry, with a mix of both benefits and drawbacks for customers and drivers.

Convenient and Cashless

Instead of chasing down a taxi on a street, or calling and waiting for a car service, e-hail app users can hail a car from any location and have it arrive in minutes. Uber doesn’t even need to ask you for an address. It knows where you are.

Professional Service

Drivers for Uber and its competitors use their own cars, and they seem incentivized to keep them clean and well-maintained. The cheapest options are late-model compacts, not junkers. The riders input their destinations into the app, and the drivers use navigational software to get there. Wrong turns are unlikely.

Competitive Pricing

It is impossible to come up with a definitive or average price for an Uber. Its pricing scheme varies with every city, and that surge pricing model changes the prices constantly based on demand. Consumer Reports also warns that the surge pricing model for both Uber and Lyft can mean much higher prices at busy times of the day.

Safety and Flexibility For Drivers

Safety is an important advantage for drivers working with Uber and other e-hail services. The riders using the service have registered their identities and their credit card numbers on the app. They are not random strangers on the street. Drivers avoid expensive taxi rental leases by using their own vehicles. They also pay their own fuel and maintenance costs. All else being equal, this may mean more profit for drivers.

Controversial Labor Practices

Uber has become a prime example of the gig economy at work. Its workers are not guaranteed a minimum wage, they have to supply and maintain their own vehicles and have few if any benefits. Some Uber drivers say they struggle to earn even a minimum wage once Uber takes its cut. They also bear most of the costs associated with the service, such as fuel, maintenance, and repairs.

Surge Pricing

“Surge pricing” for Uber, or “prime time pricing” as it is called by Lyft, is controversial among customers. It’s a classic use of the free market principle of raising or lowering prices according to supply and demand. For Uber customers, this means how many cars are available (supply) and how many passengers want to ride in them (demand).

Negative Impact of Price Competition

Price competition can be destructive for any industry. Increasingly, Uber, Lyft, and other e-hail services are engaged in an intense battle to provide the cheapest service. They are directly competing with each other and with traditional taxi and car services for both customers and drivers.

Airbnb, Salesforce, Meta Platforms, Palo Alto Networks, and Cadence Design Systems: Every day the Zacks Equity Research analysts discuss the latest news and events impacting stocks and the financial markets. Stocks recently featured in the blog include: Airbnb Inc. ABNB, salesforce.com Inc. CRM, Meta Platforms Inc. META, Verizon Stock, Palo Alto Networks Inc. PANW, and Cadence Design Systems Inc.

Uber tokenized stock FTX (UBER) Price Prediction

Uber tokenized stock FTX (UBER) price predictions/UBER forecasts by applying deep artificial intelligence-assisted Technical Analysis on the past price data of Uber tokenized stock FTX (UBER). We do our best to collect maximum historical data for the UBER coin which includes multiple parameters like past price, Uber tokenized stock FTX market cap, Uber tokenized stock FTX (UBER) volume, and a few more. If you are looking to invest in digital cryptocurrencies and want a good return on your investments, make sure to read our predictions.

Uber tokenized stock FTX (UBER) Price Prediction

| Year | Uber tokenized stock FTX (UBER) Price Prediction |

| 2023 | $35.40 to $40.44 |

| 2024 | $53.51 to $62.46 |

| 2025 | $80.04 to $92.98 |

| 2026 | $112.71 to $138.26 |

| 2027 | $170.12 to $199.46 |

| 2028 | $233.17 to $285.86 |

| 2029 | $339.37 to $401.67 |

| 2030 | $486.77 to $593.43 |

| 2031 | $695.61 to $845.03 |

| 2032 | $1,028.47 to $1,213.97 |

Uber tokenized stock FTX (UBER) Price Prediction 2023

The price of Uber tokenized stock FTX is predicted to reach a minimum value of $44.36 in 2023. The Uber tokenized stock FTX price could reach a maximum value of $51.50 with an average trading price of $46.36 throughout 2023.

Uber tokenized stock FTX (UBER) Price Prediction 2024

The price of Uber tokenized stock FTX is predicted to reach a minimum level of $66.15 in 2024. The Uber tokenized stock FTX price can reach a maximum level of $79.22 with an average price of $68.01 throughout 2024.

Uber tokenized stock FTX (UBER) Price Prediction 2025

The price of Uber tokenized stock FTX is predicted to reach a minimum value of $97.05 in 2025. The Uber tokenized stock FTX price could reach a maximum value of $116.66 with an average trading price of $99.77 throughout 2025.

Uber tokenized stock FTX (UBER) Price Prediction 2026

Uber tokenized stock FTX price is forecast to reach the lowest possible level of $145.72 in 2026. As per our findings, the UBER price could reach the maximum possible level of $167.90 with an average forecast price of $150.71.

Uber tokenized stock FTX (UBER) Price Prediction 2027

According to our deep technical analysis of past price data of UBER, In 2027 the price of Uber tokenized stock FTX is forecasted to be at around a minimum value of $226.07. The Uber tokenized stock FTX price value can reach a maximum of $263.68 with an average trading value of $232.09 in USD.

Uber tokenized stock FTX (UBER) Price Prediction 2028

According to our deep technical analysis of past price data of UBER, In 2028 the price of Uber tokenized stock FTX (UBER) is predicted to reach a minimum level of $309.58. The UBER price can reach a maximum level of $383.38 with an average trading price of $321.18.

Uber tokenized stock FTX (UBER) Price Prediction 2029

The price of 1 Uber tokenized stock FTX is expected to reach a minimum level of $455.12 in 2029. The UBER price can reach a maximum level of $540.35 with an average price of $471.18 throughout 2029.

Uber tokenized stock FTX (UBER) Price Forecast 2030

Uber Stock Price Prediction 2030: As per the forecast and technical analysis, In 2030 the price of Uber tokenized stock FTX (UBER) is expected to reach a minimum price value of $659.08. The UBER price can reach a maximum price value of $777.01 with an average value of $677.93.

Uber tokenized stock FTX (UBER) Price Prediction 2031

As per the forecast price and technical analysis, In 2031 the price of Uber tokenized stock FTX (UBER) is predicted to reach a minimum level of $957.93. The UBER price can reach a maximum level of $1,122.96 with an average trading price of $985.05.

Uber tokenized stock FTX (UBER) Price Prediction 2032

Uber tokenized stock FTX (UBER) price is forecast to reach the lowest possible level of $1,382.06 in 2032. As per our findings, the UBER price could reach the maximum possible level of $1,667.17 with the average forecast price of $1,431.31.

Better Buy: Amazon vs. Airbnb – Investors are getting excited about Amazon Stock again as it gets its costs under control while still demonstrating growth and innovation. Its stock is up 66% this year, undoing some of its losses from last year but still off its highs in 2021. Airbnb is in a similar boat, up 64% this year as it continues to demonstrate strength in a tough market but 35% off its highs just after it went public.

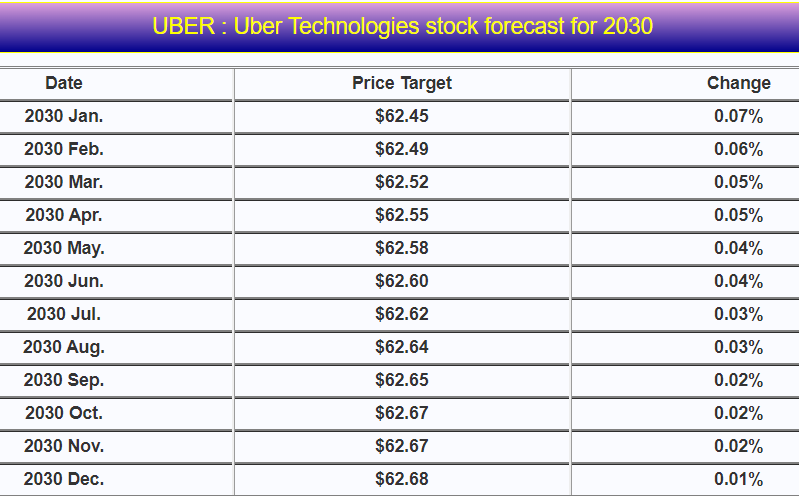

Uber Stock Price Prediction 2030, Forecast 2030

Uber tokenized stock FTX (UBER): The price value of Uber tokenized stock FTX (UBER) has changed by 3.33% in the previous 24 hours. In the last 7 days, the price of UBER has changed by 11.87%. It is limited to a maximum supply of 0 coins.

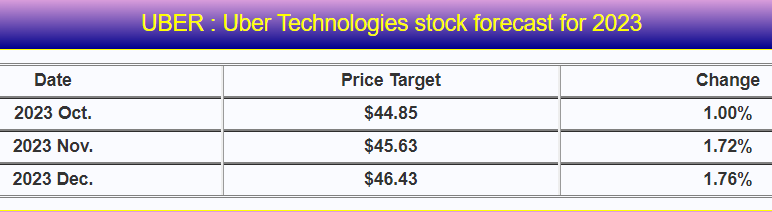

Uber Stock Price Prediction 2023

Uber tokenized stock FTX (UBER): There are signs that the crypto market is about to enter a new age. Certain that the long-term price prediction for UBER’s price will soar since there is still optimism that the currency will attract much more attention. The year 2023 can end with an average price of $37.00 and a minimum price value of $35.40. The maximum price is expected to be trading around $40.44.

Uber Stock Price Prediction 2024

It appears that by 2024, Uber tokenized stock FTX (UBER) prices will have reached a level similar to their previous all-time high. By 2024, We may expect an average price of $55.36. If everything goes smoothly, we predict the maximum price of Uber tokenized stock FTX could be up to $62.46 in 2024. Of course, there are chances that the market will dump after a long bull run and It is normal for the cryptocurrency market.

Uber Stock Price Prediction 2025

The Uber tokenized stock FTX (UBER) value will increase because of the efforts of the network developers and community investors. Therefore, the calculated price for the year 2025 is bullish. UBER was anticipated to touch a maximum price level of $92.98 by the end of 2025, according to analysts.

On the other hand, it is highly optimistic that the Uber tokenized stock FTX (UBER)’s future will ultimately grow. Therefore, the predicted average price of UBER will be around $80.04 to $82.80 is expected in 2025 depending on the market. As stated in the same slogan, the UBER’s maximum price ranges from $80.04 to $92.98 for 2025.

Uber Stock Price Prediction 2026

Uber tokenized stock FTX (UBER)’s present price range might interest many traders and because of this, UBER can reach $138.26 by 2026 with substantial cooperation with financial institutions if the following requirements are satisfied.

With an average price of $116.85 for 2026, it can beat the latest price trend to reach new highs. The price tagline can vary as the crypto market can see another bullish trend on its way to 2026.

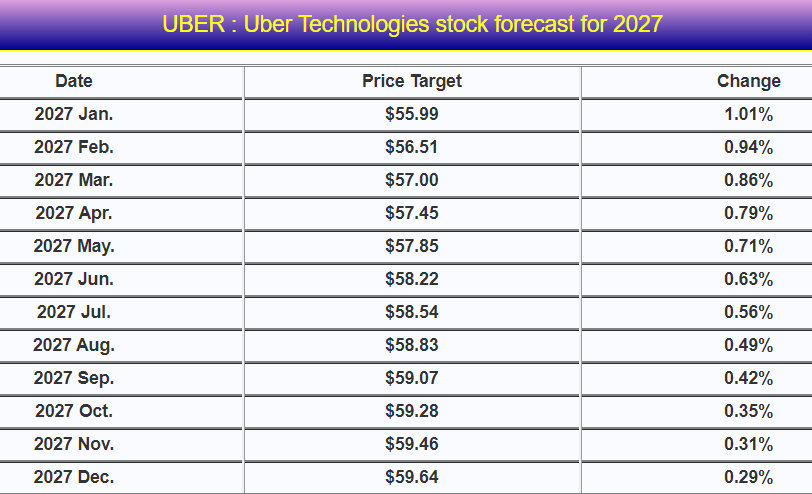

Uber Stock Price Prediction 2027

A seamless approach to this currency may be found on many websites and forums. In the opinion of this prediction platform, Uber’s tokenized stock FTX (UBER) will steady at its current price for a very long time to come. By 2027, the UBER is expected to be worth a maximum value of $199.46. The minimum price can go up to $170.12 if the market gets bullish.

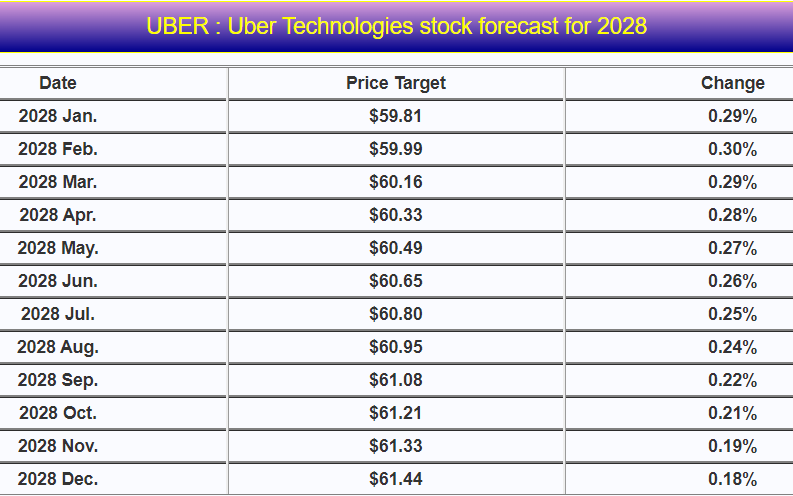

Uber Stock Price Prediction 2028

Volatility drives the cryptocurrency market. Today, it is not easy to forecast and keep up with the current pricing. Many crypto analysts come into play in this regard. The pricing forecasts are correct for the mentioned years.

Crypto consumers are still concerned about the crypto bans and new restrictions. Uber tokenized stock FTX (UBER) price may cross $285.86 if the market sees a good bull run in 2028. Given that it is expected to be held by long-term investors, its average price for 2028 will be around $241.91.

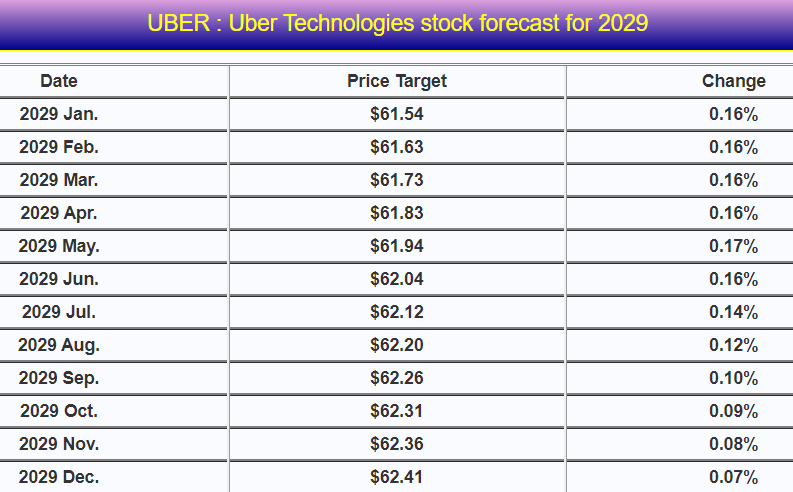

Uber Stock Price Prediction 2029

UBER will be seen as a better option, and with the huge community Uber tokenized stock FTX price will touch new highs. The price fluctuations are hard to predict, especially if the market is more bullish OR bearish than ever.

For the year 2029, the price of Uber tokenized stock FTX (UBER) will be almost $339.37. The maximum price that we can get is $401.67. Uber tokenized stock FTX’s average price forecast at the end of 2029 can be around $351.47. A huge price turnover is expected within the range defined by the crypto market.

Uber Stock Price Prediction 2030

UBER has huge potential, with certain collaborations and innovations that may increase the number of users and adoption. If the market concentrates on investing in Uber tokenized stock FTX (UBER), the price might rise much higher. By 2030, it can reach a maximum value of $593.43. It is expected that the UBER will turn around a little bit if the market goes down. The year 2030 can end with an average price of $500.82 with a minimum price of $486.77 and a maximum price of $593.43.

See Also: Investor’s Dream or Nightmare? What Will Lucid Stock Be Worth In 5 Years?

Uber Stock Price Prediction 2030, Frequently Asked Questions (FAQs)

Who owns Uber Technologies?

The current CEO of Uber company is Dara Khosrowshahi. There are more than 20 different institutional shareholders of Uber, and their combined ownership is about 71.80% of Uber.

Why is Uber Technologies charging me $9.99 a month?

Surprise subscription charges from Uber One & Uber Cash. Subscriptions renew automatically. If you see a charge for $9.99, it’s likely for Uber One. Uber Cash: A way to add funds to your Uber account.

There is an auto-refill feature.

Is Uber Technologies a good investment?

Growth is still well into the double digits in percentage terms. With its powerful network effects, it is not only well protected from a smaller rival like Lyft because it can better match drivers and riders, as well as restaurants and other businesses, but it could also see its bottom line soar in the years ahead.

What is Uber technology ranked?

Uber Technologies Inc. also received an overall rating of 78, putting it above 78% of all stocks. Software – Application is ranked 92 out of the 148 industries. UBER has an Overall Score of 78.

What is the cash flow of Uber Technologies?

Uber Technologies’ free cash flow for the twelve months ending June 30, 2023, was, a year-over-year. Uber Technologies annual free cash flow for 2022 was $0.39B, a 152.49% decline from 2021.

Uber Technologies annual free cash flow for 2021 was $-0.743B, a 77.89% decline from 2020.

When did Uber Technologies start?

Today’s leading ride-hailing app by far, Uber Technologies was founded in 2009 and quickly became the world’s most valuable startup.

Uber’s disruptive business model, explosive growth, and constant controversies have made it one of the most fascinating companies to emerge in recent years.

Why does Uber keep charging my card?

Uber may apply a temporary authorization hold for the value of the fare in advance, which will appear as a pending charge in your account’s payment method.

This is standard e-commerce practice to ensure the card has sufficient funds, and most importantly, it doesn’t result in a duplicate charge on your card.

How big is Uber Technologies?

Uber operates in 72 countries, with over 7.6 billion trips carried out. In 2022, the mobility services company generated nearly 32 billion U.S. dollars in net revenue.

What are the predictions for Uber stock?

The 39 analysts offering 12-month price forecasts for Uber Technologies Inc. have a median target of 58.00, with a high estimate of 75.00 and a low estimate of 45.00. The median estimate represents a +30.04% increase from the last price of 44.60.

What is the analyst’s prediction for Uber earnings?

Uber Technologies is forecasted to grow earnings and revenue by 49.8% and 13.5% per annum respectively. EPS is expected to grow by 49.7%. Return on equity is forecast to be 25.3% in 3 years.

Is Uber a good investment right now?

Shares of this gig-economy pioneer have soared in 2023 and Uber (UBER -4.53%), which has typically been considered a more speculative company to own, has seen its shares skyrocket 94% this year.

The transportation-as-a-service business is experiencing strong momentum right now following impressive financial results.