Barrick Gold Stock Forecast 2025: In this article, we are going to predict the stock price target of Barrick Gold Stock. Barrick Gold company was founded by Peter Munk in 1983 the headquarters is located in Toronto Canada. If we talk about Barrick Gold Stock Price Prediction then, According to Wallet Investors, “In 2025, the high price of Barrick Gold Stock will reach $32 and the average price will reach $28”.

Barrick Gold Corporation

Barrick Gold Corporation is a Canadian mining company. They produce gold and copper with 16 operating sites in 13 countries. It is located in Toronto, Ontario, Canada. It has mining operations in Argentina, Canada, Chile, Côte d’Ivoire, the Democratic Republic of the Congo, the Dominican Republic, Mali, Papua New Guinea, Saudi Arabia, Tanzania, the United States and Zambia. As of 31 December 2019, the company had 71 million ounces of proven and probable gold reserves.

Barrick had been the world’s largest gold mining company until Newmont Corporation acquired Goldcorp in 2019. Barrick expects to produce between 4.6 and five million ounces of gold and between 440 and 500 million pounds of copper in 2020. Barrick Gold has an overall rating of 4.0 out of 5, based on over 459 reviews left anonymously by employees.

82% of employees would recommend working at Barrick Gold to a friend and 60% have a positive outlook for the business. Barrick is the largest gold producer in the United States. Nevada Gold Mines (NGM) is the single largest gold mining complex in the world and anchors the group’s production from this region. No doubt it is very popular among all investors.

Barrick Gold Corporation (Barrick) carries out the exploration and development of mineral properties. It owns and operates various gold mines, which include Nevada Gold Mines, Bulyanhulu, Buzwagi, Hemlo, Kibali, Loulo-Gounkoto, North Mara, Porgera, Pueblo Viejo, Tongon, and Veladero. It carries out copper operations at Jabal Sayid, Lumwana, and Zaldivar mines.

These mines produce gold, silver, copper, and nickel commodities. It sells gold bullion in the gold spot market, and gold and copper concentrate to independent smelting companies. The company together with its subsidiaries has operations in the Americas, Africa, the Middle East, and Oceania. Barrick is headquartered in Toronto, Ontario, Canada.

Meta Stock vs. Barrick Gold Stock: Barrick Gold Stock Corporation’s competitors and similar companies include Meta Stock, Newmont, Rio Tinto, Agnico Eagle, and Kinross Gold Corporation. Barrick Gold Corporation’s analyst rating consensus is a Strong Buy. This is based on the ratings of 10 Wall Street analysts.

History of Barrick Gold Corporation

Barrick Gold Corporation 2003

Ongoing exploration and drilling continue in the region, as well as on properties in Canada, South America, and Africa, with projections to reach more than five million ounces of gold production by 2003.

Barrick Gold Corporation 2005

The company offered US $9.2 billion for Placer Dome Inc. in a bid announced on October 31, 2005. The MPs also criticized the government for not revoking tax exemptions on mining companies following the revocation of a 2005 Government Notice that allowed the benefit.

Barrick Gold Corporation 2006

On August 14, 2006, NovaGold filed a lawsuit in British Columbia, Canada alleging that Barrick misused confidential information to make its bid for Pioneer Metals. The transaction closed in early 2006, making Barrick the world’s largest gold producer.

Barrick Gold Corporation 2007

In November 2007, NovaGold and Teck Cominco announced the suspension of the Galore Creek project and Nova Gold’s share plummeted. Despite increasing dissatisfactions with Barrick, the government in 2007 concluded a ‘development agreement’ with the company for a new mine at Buzwagi.

Barrick Gold Corporation 2009

Barrick Gold created the largest stock offering in Canadian history in 2009 when it issued a $3 billion equity offering, which was increased the following day to $3.5 billion in response to market demand. In 2009 Members of Parliament pressed for the closure of the North Mara Gold Mine Barrick gold mine for poisoning a vital river, the Tigithe River. The Buzwagi project poured the first gold in the second quarter of 2009, contributing about 200 thousand ounces in 2009 at total cash costs of about US$320 to US$3357 per ounce.

Barrick Gold Corporation 2010

African Barrick Gold was listed on the London Stock Exchange in mid-March 2010, with an IPO valuation of US$3.6 billion.

Barrick Gold Corporation 2013

In August 2013 Barrick agreed to sell its Yilgarn South assets in Western Australia to South Africa’s Gold Fields for $US300 million divesting its granny Smith Dart and Lawlers mine operations.

See Also: Ethereum Guide For Beginners And 10 Advantages

Brkb stock vs. Barrick Gold Stock: Warren Buffett bought an approximate stake of US$565 million in Barrick Gold Stock in Q2 2020. Berkshire’s stock (Brkb stock) performance has generally been solid, increasing at a 9.5% CAGR during 2018-22, compared with a 9.4% average annual return for the S&P 500 TR Index.

Barrick Stock Overview

| Industry | Mining |

| Revenue | $9.7B |

| Headquarters | Salt Lake City, UT |

| Employees | 18,421 |

| Founded In | 2003 |

| Organization Type | Private |

| CEO | Dennis Mark Bristow |

| Company Name | BARRICK GOLD CORPORATION |

| Market Cap | $38.27B |

| Dividend | $0.14 |

| Shares Out | 1.76B |

| Debt to Equity (MRQ) | 20.90% |

| 52 Week High/Low | 17.88 – 28.19 |

| ROE (TTM) | -0.29% |

| EPS (TTM) | -0.04 |

| Stock P/E | -405.33 |

Barrick Gold Pay

The average Barrick Gold salary in the United States is $57,380 per year. Barrick Gold salaries range between $32,000 a year in the bottom 10th percentile to $99,000 in the top 90th percentile. Barrick Gold pays $27.59 an hour on average.

Barrick Gold salaries vary by department as well. Barrick Gold salaries in the IT department average $87,413 per year, while salaries in the research & development department average $research & development per year. Barrick Gold salaries are also impacted by geographic location. Barrick Gold employees in Pleasanton, CA, and Elko, NV get paid the most.

Barrick Gold’s Revenue

Barrick Gold’s annual revenue is $9.7B. Zippia’s data science team found the following key financial metrics about Barrick Gold after extensive research and analysis. Barrick Gold has 18,421 employees, and the revenue per employee ratio is $527,495. Barrick Gold’s peak revenue was $9.7B in 2022.

See Also: Investor’s Dream or Nightmare? What Will Lucid Stock Be Worth In 5 Years?

Barrick Gold Stock vs. Uber Technologies Inc.: Barrick Gold Stock purchased Goldstrike, which was a rapid success making Barrick one of the biggest gold mining companies globally compared to Uber Technologies Inc.

Barrick Gold demographics

Zippia estimates demographics and statistics for Barrick Gold by using a database of 30 million profiles. Our estimates are verified against BLS, Census, and current job openings data for accuracy. After extensive research and analysis, Zip pia’s data science team found that:

- Barrick Gold has 18,421 employees.

- 25% of Barrick Gold employees are women, while 75% are men.

- The most common ethnicity at Barrick Gold is White (60%).

- 20% of Barrick Gold employees are Hispanic or Latino.

- 8% of Barrick Gold employees are Asian.

- The average employee at Barrick Gold makes $57,380 per year.

- Barrick Gold employees are most likely to be members of the democratic party.

- Employees at Barrick Gold stay with the company for 4.9 years on average.

THE CULTURE AT BARRICK GOLD

A comprehensive compensation package including bonuses benefits, and stock purchase plans where applicable. Ability to make a difference and lasting impact. Work in a dynamic, collaborative, progressive, and high-performing team. An Opportunity to transform Traditional Mining into the future of Digital Mining. Opportunities to grow and learn with industry colleagues are endless. Access to a variety of career opportunities across Nevada Gold Mine locations. Nevada Gold Mines is committed to creating a diverse environment and is proud to be an equal-opportunity employer.

An Opportunity to transform Traditional Mining into the future of Digital Mining. Opportunities to grow and learn with industry colleagues are endless. Access to a variety of career opportunities across Nevada Gold Mine locations. Opportunities to grow and learn with industry colleagues are endless. Access to a variety of career opportunities across Nevada Gold Mine locations.

An Opportunity to transform Traditional Mining into the future of Digital Mining. Opportunities to grow and learn with industry colleagues are endless. A comprehensive compensation package including bonuses benefits, and stock purchase plans where applicable. Ability to make a difference and lasting impact. Work in a dynamic, collaborative, progressive, and high-performing team.. Access to a variety of career opportunities across Nevada Gold Mine locations. Nevada Gold Mines is committed to creating a diverse environment and is proud to be an equal-opportunity employer.

See Also: Amazon Stock Price Prediction 2030 After Split

Operations

In line with its commitment to finding, developing, and operating the best assets, Barrick is focused on high-margin, long-life operations and projects clustered in the world’s most prospective gold districts, and supporting these with a robust copper business.

Gold Operations

Nevada Gold Mines (United States)

Nevada Gold Mines is a joint venture between Barrick (61.5%) and Newmont (38.5%) that combined its significant assets across Nevada in 2019 to create the single largest gold-producing complex in the world. Nevada Gold Mines is operated by Barrick.

Bulyanhulu (Tanzania)

Bulyanhulu is situated in northwest Tanzania, in the Kahama district of the Shinyanga region, approximately 55 kilometers south of Lake Victoria and 150 kilometers southwest of the city of Mwanza.

Bulyanhulu is a narrow-vein gold mine containing gold, silver, and copper mineralization in sulfides. The mineralization of Bulyanhulu is associated with a number of steeply dipping veins. Bulyanhulu commenced commercial production in 2001.

Hemlo (Canada)

Hemlo has produced more than 21 million ounces of gold and has been operating continuously for more than 30 years. It consists of the Williams mine—an underground and open pit operation—located about 350 kilometers east of Thunder Bay, Ontario.

Kibali (Democratic Republic of Congo)

The Kibali gold mine is located in the northeast of the Democratic Republic of Congo (DRC), approximately 220 kilometers east of the capital of the Haut Uele province, Isiro, 150 kilometers west of the Ugandan border town of Arua and 1,800 kilometers from the Kenyan port of Mombasa. The mine is owned by Kibali Goldmines SA (Kibali) which is a joint venture company effectively owned 45% by each of Barrick and AngloGold Ashanti, and 10% by Société Miniére de Kilo-Moto (SOKIMO). The mine is operated by Barrick.

Loulo-Gounkoto (Mali)

The Loulo-Gounkoto complex comprises two distinct mining permits, Loulo and Gounkoto, and is situated in western Mali, bordering Senegal and adjacent to the Falémé River.

Société des Mines de Loulo SA (Loulo) owns the Loulo gold mine, and Société des Mines de Gounkoto (Gounkoto) owns the Gounkoto gold mine. Both Loulo and Gounkoto are owned by Barrick (80%), and the State of Mali (20%).

North Mara (Tanzania)

The North Mara gold mine is located in northwest Tanzania in the Tarime district of the Mara region. It is around 100 kilometers east of Lake Victoria and 20 kilometers south of the Kenyan border.

North Mara started commercial production in 2002. The mine is a combined open pit and underground operation from two deposits, Gokona (underground) and Nyabirama (open pit). The process plant has the capacity to process an average of 8,000 tonnes of ore per day.

Porgera (Papua New Guinea)

The Porgera Joint Venture is an open pit and underground gold mine located at an altitude of 2,200-2,600 meters in the Enga Province of Papua New Guinea, about 600 kilometers northwest of Port Moresby.

Pueblo Viejo (Dominican Republic)

Pueblo Viejo is located in the Dominican Republic, approximately 100 kilometers northwest of the capital city of Santo Domingo, and is operated by the Pueblo Viejo Dominicana Corporation — a joint venture between Barrick (60%) and Newmont (40%). Construction of the project started in 2008, and first production occurred in 2012.

Tongon (Côte d’lvoire)

The Tongon gold mine is located within the Nielle mining permit, 628 kilometers north of the Côte d’Ivoire port city of Abidjan, and 55 kilometers south of the border with Mali. The Tongon gold mine and associated mining permit are owned by Société des Mines de Tongon SA (Tongon), in which Barrick has an 89.7% interest, the State of Côte d’Ivoire 10%, and 0.3% is held by Ivorian investors.

Veladero (Argentina)

The Veladero mine is located in San Juan Province, Argentina, in the highly prospective Frontera District. The property is located at elevations of 4,000 to 4,850 meters above sea level, approximately 374 kilometers northwest of the city of San Juan. Veladero is a 50/50 joint venture operation with Shandong Gold.

Twitter Stock and Barrick Gold Stock: Weak demand for Barrick Gold Stock Corp.’s $3 billion share sale signals with Twitter Stock that the worst isn’t over for the gold industry after slumping metal prices and rising costs at mining projects scared off investors.

Copper Operations

Jabal Sayid (Saudi Arabia)

The Jabal Sayid copper operation is located 350 kilometers northeast of Jeddah in the Kingdom of Saudi Arabia. It’s a 50/50 joint venture operation with Ma’aden. The first shipment of copper concentrate occurred in December 2015, and the mine commenced commercial production in July 2016.

Lumwana (Zambia)

The Lumwana copper mine is a conventional open pit (truck and shovel) operation. It’s located about 100 kilometers west of Solwezi in Zambia’s Copperbelt — one of the most prospective copper regions in the world. Lumwana ore, which is predominantly sulfide, is treated through a conventional sulfide flotation plant, producing copper concentrate.

Zaldívar (Chile)

The Zaldívar copper mine is a 50/50 joint venture with Antofagasta Plc, the operator of the mine. It’s located in the Andean Precordillera in Region II of northern Chile, approximately 1,400 kilometers north of Santiago and 196 kilometers southeast of the port city of Antofagasta.

See Also: Verizon Stock Forecast 2025: Insights and Analysis

Barrick Gold Stock Price Prediction 2025, 2030, 2040, 2050

Barrick Gold Stock Price Prediction 2025

In the June quarter of 2023, the revenue grew by the previous quarter in 31 of marks the revenue of companies 3.55 billion now in June 2023 the revenue is increased to 3.82 billion. In the same way as the company increasing its total revenue the Barrick Stock Price Prediction 2025 minimum is $10 and the maximum is $28.

Barrick Gold Stock Price Prediction 2030

The company’s net income increased in two quarters. In the March quarter, the company’s net income increased by 116.27%, and June quarter of 2023 the company’s net income increased by 152.38%. Barrick Stock Price Prediction 2030 minimum is $25 and the Maximum is $70.

Barrick Gold Stock Price Prediction 2040

The company has a strong operating cash flow of $832 million dollars which increased by 7% compared to Q1. Companies also maintain quarterly dividends of $0.10 per share. Barrick Gold Stock Price Prediction 2040 minimum is $60 and the maximum is $150.

Barrick Gold Stock Price Prediction 2050

Nevada has three gold mines in the USA which are hosted by the Barrick Gold Corporation. According to the company report the growth in gold till 2050 increased by 70%. Barrick Gold Stock Price Prediction 2050 minimum is $150 and the maximum is $450.

Long-Term Barrick Gold Stock Price Predictions

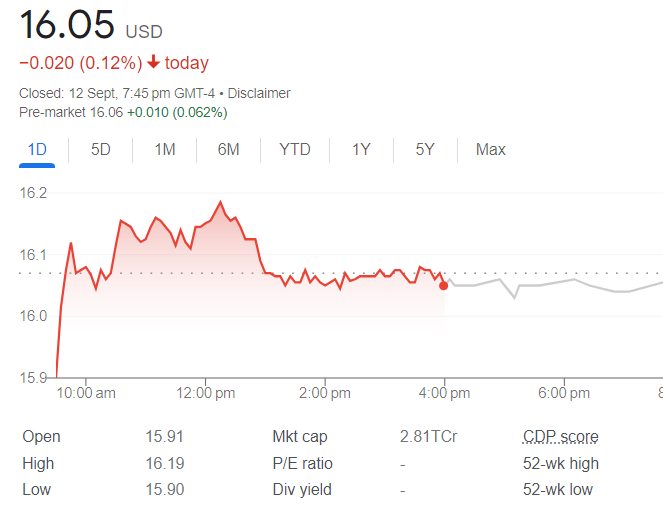

Based on the average yearly growth of the Barrick Gold stock in the last 10 years, the Barrick Gold stock forecast for the beginning of next year is $ 15.99. Using the same basis, here is the Barrick Gold stock prediction for each year up until 2030.

| Year | Prediction | Change |

| 2024 | $ 15.99 | 1.35% |

| 2025 | $ 16.21 | 2.71% |

| 2026 | $ 16.43 | 4.09% |

| 2027 | $ 16.65 | 5.50% |

| 2028 | $ 16.87 | 6.92% |

| 2029 | $ 17.10 | 8.36% |

| 2030 | $ 17.33 | 9.82% |

See Also: Meta Stock Price Prediction 2040: Insight And Analysis

Barrick Gold Stock Forecast 5 Years

Barrick Gold Stock Forecast 2023

Barrick Gold Stock Monthly Prediction for January, February, March, April, May, July, July, August, September, October, November, and December 2023. We predict the dynamics of the stock market value using resonant artificial intelligence systems. Technical, fundamental analyses, news background, the general geopolitical situation in the world, and other factors are taken into account. Forecasts are adjusted once a day taking into account the price change of the previous day.

GOLD Forecast for 2023

| Month | Rate Forecast | MIN Rate | MAX Rate | Volatility, % |

| Oct | 18.59 | 17.88 | 19.81 | 9.71 % |

| Nov | 19.64 | 18.93 | 20.49 | 7.59 % |

| Dec | 19.62 | 18.40 | 20.77 | 11.39 % |

Barrick Gold Stock Forecast 2024

Barrick Gold Stock Stock Monthly Prediction for January, February, March, April, May, July, July, August, September, October, November and December 2024. We predict the dynamics of the stock market value using resonant artificial intelligence systems. Technical, fundamental analyses, news background, the general geopolitical situation in the world, and other factors are taken into account.

GOLD Forecast for 2024

| Month | Rate Forecast | MIN Rate | MAX Rate | Volatility, % |

| Jan | 19.75 | 18.36 | 20.55 | 10.64 % |

| Feb | 19.91 | 19.12 | 20.34 | 5.99 % |

| Mar | 21.48 | 20.61 | 21.91 | 5.91 % |

| Apr | 22.57 | 21.45 | 23.79 | 9.82 % |

| May | 22.00 | 21.60 | 22.69 | 4.80 % |

| Jun | 22.27 | 21.11 | 23.18 | 8.91 % |

| Jul | 21.33 | 20.45 | 21.74 | 5.92 % |

| Aug | 22.02 | 21.25 | 23.01 | 7.67 % |

| Sep | 21.96 | 21.19 | 23.01 | 7.90 % |

| Oct | 21.77 | 20.83 | 23.31 | 10.67 % |

| Nov | 21.10 | 20.70 | 21.80 | 5.05 % |

| Dec | 22.58 | 21.32 | 24.05 | 11.33 % |

Barrick Gold Stock Forecast 2025

Barrick Gold Stock Stock Monthly Prediction for January, February, March, April, May, July, July, August, September, October, November, and December 2025. We predict the dynamics of the stock market value using resonant artificial intelligence systems. Technical, fundamental analyses, news background, the general geopolitical situation in the world, and other factors are taken into account.

GOLD Forecast for 2025

| Month | Rate Forecast | MIN Rate | MAX Rate | Volatility, % |

| Jan | 21.99 | 21.48 | 22.76 | 5.65 % |

| Feb | 23.42 | 22.26 | 25.10 | 11.33 % |

| Mar | 25.06 | 24.52 | 25.65 | 4.40 % |

| Apr | 26.64 | 25.15 | 28.06 | 10.34 % |

| May | 25.25 | 24.48 | 26.48 | 7.55 % |

| Jun | 25.57 | 24.97 | 27.06 | 7.74 % |

| Jul | 25.64 | 24.41 | 27.14 | 10.03 % |

| Aug | 25.84 | 24.05 | 27.68 | 13.11 % |

| Sep | 25.91 | 24.40 | 26.47 | 7.84 % |

| Oct | 27.22 | 26.61 | 29.11 | 8.58 % |

| Nov | 28.13 | 26.38 | 28.91 | 8.76 % |

| Dec | 27.80 | 26.82 | 28.50 | 5.88 % |

Barrick Gold Stock Forecast 2026

Barrick Gold Stock Stock Monthly Prediction for January, February, March, April, May, July, July, August, September, October, November and December 2026. We predict the dynamics of the stock market value using resonant artificial intelligence systems. Technical, fundamental analyses, news background, the general geopolitical situation in the world, and other factors are taken into account.

GOLD Forecast for 2026

| Month | Rate Forecast | MIN Rate | MAX Rate | Volatility, % |

| Jan | 27.42 | 25.50 | 28.68 | 11.10% |

| Feb | 26.48 | 25.77 | 28.13 | 8.39% |

| Mar | 26.39 | 24.92 | 27.89 | 10.65% |

| Apr | 27.41 | 25.78 | 29.16 | 11.59% |

| May | 27.34 | 26.45 | 28.42 | 6.93% |

| Jun | 29.06 | 28.41 | 30.71 | 7.49% |

| Jul | 31.39 | 30.03 | 33.00 | 8.99% |

| Aug | 30.88 | 28.88 | 32.18 | 10.28% |

| Sep | 33.18 | 32.44 | 35.31 | 8.12% |

| Oct | 32.95 | 30.66 | 34.16 | 11.40% |

| Nov | 33.18 | 31.69 | 34.47 | 8.06% |

| Dec | 33.84 | 33.17 | 36.19 | 8.33% |

Barrick Gold Stock Forecast 2027

Stock Monthly Prediction for January, February, March, April, May, July, July, August, September, October, November and December 2027. We predict the dynamics of the stock market value using resonant artificial intelligence systems. Technical, fundamental analyses, news background, the general geopolitical situation in the world, and other factors are taken into account.

GOLD Forecast 2027

| Month | Rate Forecast | MIN Rate | MAX Rate | Volatility, % |

| Jan | 205.29 | 188.29 | 217.61 | 13.47% |

| Feb | 205.78 | 187.02 | 210.72 | 11.25% |

| Mar | 205.29 | 185.58 | 222.54 | 16.61% |

| Apr | 207.02 | 187.89 | 226.39 | 17.01% |

| May | 229.87 | 223.25 | 243.66 | 8.38% |

| Jun | 227.39 | 216.75 | 239.94 | 9.67% |

| Jul | 214.02 | 202.46 | 224.80 | 9.94% |

| Aug | 220.69 | 213.28 | 228.64 | 6.72% |

| Sep | 223.87 | 207.48 | 245.36 | 15.44% |

| Oct | 217.96 | 206.72 | 230.52 | 10.33% |

| Nov | 218.22 | 197.80 | 236.55 | 16.38% |

| Dec | 218.49 | 199.87 | 230.02 | 13.11% |

See Also: Predicting the Future: A Mind-Blowing Analysis of WBD Stock Forecast 2025

Barrick Gold Stock Forecast 2025 Frequently Asked Questions (FAQs)

What is the Barrick Gold stock forecast?

The Barrick Gold stock forecast for tomorrow is $ 15.59, which would represent a -1.19% loss compared to the current price. In the next week, the price of GOLD is expected to increase by 5.16% and hit $ 16.59.

What is the Barrick Gold stock prediction for 2025?

According to our Barrick Gold stock prediction for 2025, GOLD stock will be priced at $ 16.21 in 2025. This forecast is based on the stock’s average growth over the past 10 years.

What is the Barrick Gold stock prediction for 2030?

According to our Barrick Gold stock prediction for 2030, GOLD stock will be priced at $ 17.33 in 2030. This forecast is based on the stock’s average growth over the past 10 years.

Will Barrick Gold stock reach $100?

Barrick Gold stock would need to gain 533.71% to reach $100. According to our Barrick Gold stock forecast, the price of Barrick Gold stock will not reach $100. The highest expected price our algorithm estimates is $ 17.36 by Oct 22, 2023.

Will Barrick Gold stock reach $500?

Barrick Gold stock would need to gain 3,068.57% to reach $500. According to our Barrick Gold stock forecast, the price of Barrick Gold stock will not reach $500. The highest expected price our algorithm estimates is $ 17.36 by Oct 22, 2023.

Will Barrick Gold stock reach $1,000?

Barrick Gold stock would need to gain 6,237.14% to reach $1,000. According to our Barrick Gold stock forecast, the price of Barrick Gold stock will not reach $1,000. The highest expected price our algorithm estimates is $ 17.36 by Oct 22, 2023.

Is Barrick Gold a good stock to buy?

Based on our Barrick Gold stock forecast, Barrick Gold stock is currently not a good stock to buy. This is because the price of Barrick Gold stock is expected to increase by -39.25% in the next year.

Will Barrick Gold stock go down tomorrow?

Our prediction anticipates that Barrick Gold stock will go down tomorrow. Our forecast estimates that GOLD will lose -1.19% in the next day and reach a price of $ 15.5

What’s the Barrick Gold stock price prediction for next week?

The Barrick Gold stock price prediction for next week is $ 16.59, which would represent a 5.16% gain in the GOLD stock price.

What’s the Barrick Gold stock price prediction for tomorrow?

The Barrick Gold stock price prediction for tomorrow is $ 15.59, based on the current market trends. According to the prediction, the price of GOLD stock will decrease by -1.19% in the next day.

Will Barrick Gold stock go up tomorrow?

According to our prediction, Barrick Gold stock will not go up tomorrow. Based on the current trends, our prediction estimates that the price of GOLD stock will decrease by -1.19% in the next day.

What is the future of Barrick Gold?

The 22 analysts offering 12-month price forecasts for Barrick Gold Corp have a median target of 22.13, with a high estimate of 29.00 and a low estimate of 17.20. The median estimate represents a +37.19% increase from the last price of 16.13.