Introduction

Forecasting stock prices is vital in finance, especially for investors seeking information about Meta stock price prediction 2040 following Facebook’s rebranding. According to the analysis, it is expected that Meta Stock Price may touch the $2150 mark in 2040. Being one of the largest social media platforms globally, Facebook has witnessed substantial growth over the past decade. This stock remains hot pick for all the investors among the globe.

Nevertheless, concerns over data privacy and competition from other platforms raise uncertainties about the future of the company’s stock price. Our comprehensive forecast analysis delves into the historical performance of Facebook’s stock prices, evaluates the prevailing market conditions, and presents predictions for Meta’s stock prices.

By analyzing industry trends and financial data, investors can gain valuable insights to make informed decisions about their portfolios. Get ready to explore the captivating realm of (Facebook) Meta stock price prediction 2040.

History of Meta Stock (Facebook Stock)

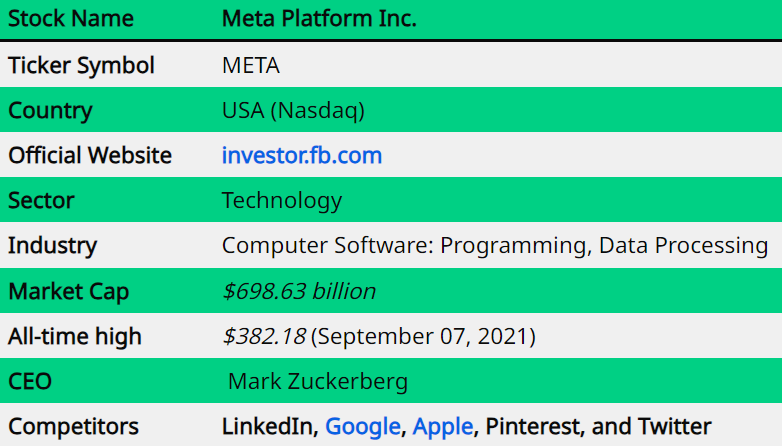

Meta Platforms Inc., formerly known as Facebook Inc., stands as a leading social media and technology company. Traded under the ticker symbol “META” on the NASDAQ exchange, it has a proven track record of strong stock performance. The company derives its revenue primarily from advertising, capitalizing on its expansive user base.

However, Meta Platforms have encountered regulatory scrutiny in relation to data privacy and antitrust concerns. In a strategic move to underscore its commitment to the metaverse, the company underwent a rebranding, adopting the name Meta Platforms Inc. This virtual realm aims to redefine human interactions and connectivity, pushing the boundaries of technological innovation.

Also Check: Verizon’s Stock Price Prediction

Learnings From The Past To Know Meta Stock Price Prediction 2040

Meta Platforms has demonstrated a history of strategic investments in cutting-edge technologies and successful acquisitions, such as Instagram and WhatsApp, which have contributed significantly to its growth and expansion. The company places immense importance on user engagement, continuously enhancing user experiences, and exploring novel features and services to maximize monetization opportunities.

It is important to note that investing in stocks entails risks, and conducting thorough research and seeking financial advice is highly recommended. For accurate and up-to-date information, Meta Platforms’ official financial reports and statements serve as reliable sources. In conclusion, Meta Platforms Inc. remains a dominant force within the social media industry, adeptly navigating regulatory challenges while relentlessly pursuing innovation to uphold its market position and propel future growth.

Meta Stock Price History Over The Time

On May 18, 2012, Meta Platform, previously known as Facebook, made its debut as a public company with an initial public offering (IPO) price of $38 per share. The stock price experienced a surge on its first day of trading, reaching $45 per share, but subsequently dipped below the IPO price in the weeks that followed.

However, in 2013, the stock price began a steady ascent, culminating in a new high of $54 per share in January 2014. Over the following years, the stock continued its upward trajectory, reaching an impressive all-time high of $218 per share in July 2018. Unfortunately, concerns surrounding data privacy and the Cambridge Analytica scandal caused a significant decline, with the stock price plummeting to $123 per share in December 2018.

Despite this setback, the stock rebounded in 2019, attaining a new high of $224 per share in July of that year. The year 2020 posed challenges due to the COVID-19 pandemic, causing a temporary dip in the stock price. Nevertheless, the stock quickly recovered and soared to a remarkable all-time high of $304 per share in August 2021.

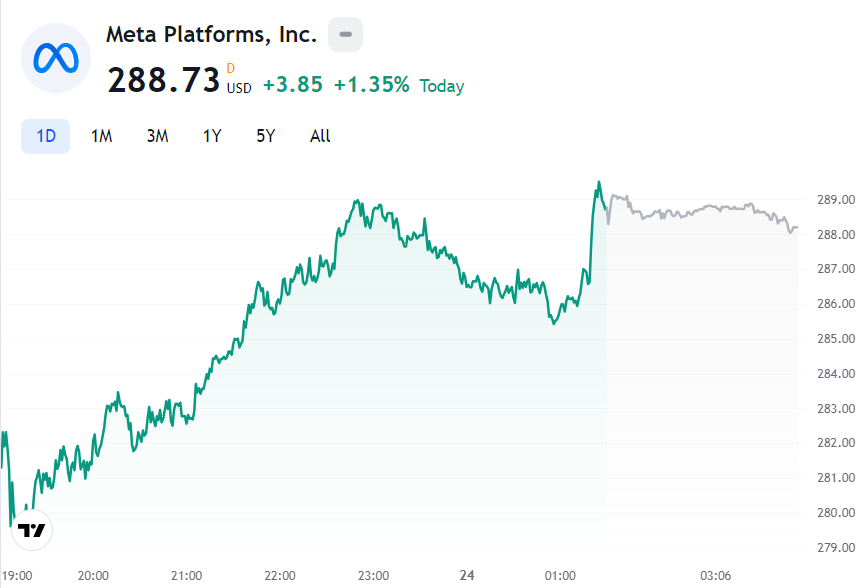

As of September 2021, the Meta Stock Price hovers around $340 per share, solidifying its position as a market leader with a market capitalization exceeding $970 billion.

Discover the potential of Meta stock price prediction 2040. As a prominent tech giant, formerly known as Facebook, Meta has encountered its fair share of controversies, underscoring the need for investors to stay informed and vigilant. By meticulously analyzing these forecasts, you will be equipped to make well-informed decisions regarding the opportune time to invest in Meta (FB) stock.

Analysts’ long-term predictions indicate a promising outlook, with Meta Platforms, Inc (FB) stock poised for significant growth in the years ahead. It is projected that by the conclusion of 2023, the price of Meta will soar to $272, followed by a further increase to $360 in 2024. The upward trajectory is expected to persist, propelling Meta’s stock price to $470 in 2025, $580 in 2027, and an awe-inspiring $765 by 2030.

Conclusion

Meta Stock is an intriguing stock to watch in the coming years. By understanding the factors influencing its price, analyzing historical data, and utilizing advanced prediction techniques, investors can gain valuable insights into its future performance. However, it is important to remember that stock market predictions always carry a degree of uncertainty. Conducting thorough research, consulting financial experts, and diversifying investments is essential for making informed decisions.

Frequently Asked Questions (FAQs)

Can stock price prediction guarantee profits?

No, stock price prediction cannot guarantee profits. It provides insights and probabilities but does not eliminate risks associated with investments.

Is machine learning necessary for stock price prediction?

Machine learning can enhance stock price prediction by analyzing vast amounts of data and identifying patterns, but it is not the only approach. Other techniques like technical and fundamental analysis are also valuable.

How reliable are long-term stock predictions?

Long-term stock predictions carry more uncertainty compared to short-term predictions. They depend on numerous factors and market dynamics that can change over time.

Should I solely rely on Meta stock price predictions for investment decisions?

It is advisable to use Meta stock price predictions as one of the many tools for decision-making. Consulting financial experts and conducting thorough research are essential for a well-rounded investment strategy.

What are some risks associated with investing in Meta Stock?

Investing in Meta Stock carries typical market risks, including volatility, economic fluctuations, and industry-specific risks. It is important to assess and manage these risks when making investment decisions.