According to the report Bloomberg, Palantir (PLTR) Stock is going to be the best pick for large contracts due to the United Kingdom’s National Health Service overhaul. The five-year contract can be extended for two more years whose worth stands at around $579 million.

Will Palantir Hit $100?: Palantir Technologies Inc. (Palantir) is a software company that develops data fusion platforms. The company facilitates machine-assisted and human-driven data analysis. Its product platform includes Palantir Gotham, Plantir Apollo, and Palantir Foundry.

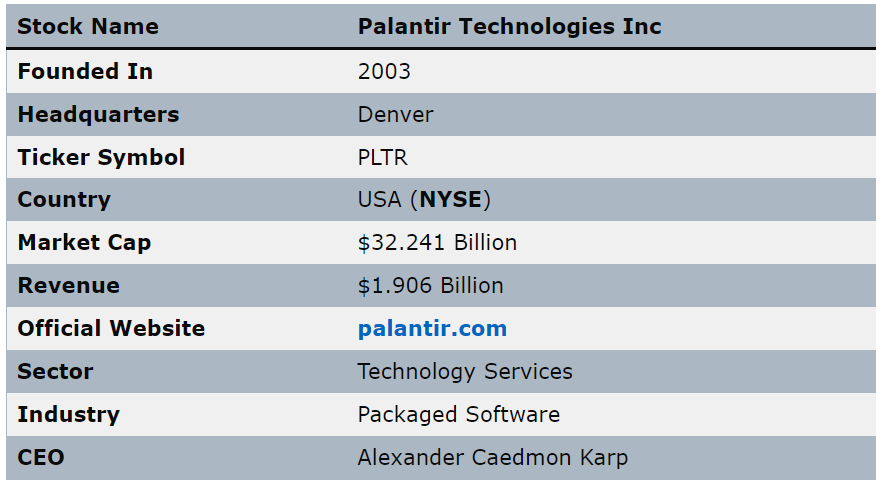

Palantir Technologies Inc.

Palantir Technologies Inc.: Palantir Gotham integrates, manages, secures, and analyzes user’s enterprise data, Plantir Apollo is a software, that powers the company’s SaaS platforms. Its Palantir Foundry allows users to create various tables, applications, reports, and presentations. The company provides solutions for automotive, cyber, financial compliance, insurance analytics, law enforcement, case management, defense, insider threat, and legal intelligence among others. It serves various private enterprises, public institutions, and non-profit organizations. The company has operations in North America, Europe, Asia, and the Middle East. Palantir is headquartered in Palo Alto, California, the US.

Work

Palantir Technologies Inc.: Named after the sinister seeing stones in the Lord of the Rings series, Palantir helps its clients analyze data to solve complicated problems or optimize operations by building platforms with search features and visualizations. Its tools are primarily adopted for surveillance and security, and its biggest customers are law enforcement agencies like the FBI, CIA, ICE, police departments, and the U.S. Army. The data is often extremely sensitive or proprietary.

Palantir’s CEO, Alexander Karp, has described their new artificial intelligence service as “transformative” for the company. In a letter to shareholders, he revealed that they are in talks with more than 300 customers to implement Palantir’s new Artificial Intelligence Platform. This platform enables large language models to analyze private data. Karp emphasized that the demand for this AI service is unprecedented, surpassing anything they have experienced in the past two decades.

Palantir has announced a stock-buyback program worth up to $1 billion. The company’s decision is supported by a strong adjusted free cash flow of $285 million in the first half of the year and a robust balance sheet, which shows $3.1 billion in cash and equivalents by the end of the second quarter.

For the third quarter, Palantir anticipates revenue ranging from $553 million to $557 million and expects to achieve GAAP profitability. Furthermore, the company projects reporting GAAP net income in the fourth quarter and forecasts a total revenue of over $2.212 billion for the full year.

The significance of Microsoft, Meta Platforms, and Palantir Technologies’ stock performance: The stock performance of Microsoft, Meta Platforms, and Palantir Technologies following NVIDIA’s report may not have a direct and immediate connection to each other or to NVIDIA’s report. Meta Stock prices are influenced by a multitude of factors, including a company’s financial performance, industry trends, market sentiment, and global economic conditions. Therefore, the performance of these companies’ stocks should be analyzed independently.

Will Palantir Hit $100 by 2030?

Will Palantir Hit $100 by 2030? – Palantir’s impact on reducing NHS waitlists: Isla Health, in collaboration with Palantir Technologies, is deploying its digital health solutions across various NHS sites to address patient waitlist management. Isla Health’s system is integrated with Palantir’s Foundry operating system, allowing clinical teams to set patients on monitoring pathways and automatically surface data into Foundry. One example of their collaboration is the Digital Health Questionnaire (DHQ), implemented at Chelsea and Westminster Hospital NHS Foundation Trust.

In order for Palantir to reach $100, it would need to increase by a factor of 5.5. At $100, Palantir’s Market Cap will be $209.6 billion. If Palantir were to grow at a rate of 25% each year, it would take about 7.6 years to reach $100. Let us evaluate this data

Quality of Investment: Good

Growth required to reach $100: Feasible

Market Cap at $100: Partially Feasible

Time required to reach $100 if Palantir were to rise at 25% per annum: Feasible

Considering the criteria of quality of Investment: growth required, and time required, Palantir has a good chance of reaching $100.

Palantir vs. Barrick stocks: Buying stock in Palantir Technologies, SoFi Technologies, Occidental Petroleum, and Barrick Gold: The price of gold has dipped by about 1.3%. Barrick Gold Corp. has seen its share price plunge by 30% over the same period. Barrick stock has dropped by nearly 28%. Lower gold prices played a role, of course, but the bigger problem for Barrick was a July announcement that its costs were going to be 3% to 5% higher in the second quarter than previously forecast.

Can Palantir Reach $1000?

Strong growth prospects:

Can Palantir Reach $1000?: Palantir is a data analytics company that provides software and services to government agencies and businesses. The company is growing rapidly, with revenue increasing by 45% in the most recent quarter. Palantir is well-positioned to continue to grow in the coming years, as more and more organizations adopt its software and services.

Large addressable market:

Can Palantir Reach $1000?: Palantir’s software and services can be used in a wide variety of industries, including government, healthcare, financial services, and manufacturing. This gives the company a large addressable market, with the potential to generate significant revenue in the coming years.

Strong customer base:

Can Palantir Reach $1000?: Palantir has a strong customer base. The company’s customers include some of the largest and most important organizations in the world, such as the US Department of Defense, the CIA, and the NHS.

Disney, AT&T, Tesla, Verizon, Palantir: Tesla stock closed 3.20% higher on Monday at $290.38. The stock had an intraday high of $292.23 and an intraday low of $283.57. The Verizon stock had an intraday high of $33.65 and an intraday low of $31.25. The stock has a 52-week high of $51.17 and a 52-week low of $31.25. Palantir, Amazon Stock, and Nio could be excellent stocks to consider. This video will highlight which one of these growth stocks is the best stock to buy now.

Palantir Stock Price Prediction 2023, 2024, 2025, 2030, 2040, 2050, 2060

Palantir Stock Price Prediction: Palantir Technologies Inc. (PLTR) is an American software company specializing in data analytics and intelligence solutions. It was founded in 2003 by Peter Thiel, Alex Karp, Joe Lonsdale, and Stephen Cohen.

Palantir Stock Price Prediction Table (2023 to 2060)

| Year Minimum | Stock Price | Average | Maximum Stock Price |

| 2023 | $8.90 | $13.50 | $18.10 |

| 2024 | $19.40 | $22.50 | $25.00 |

| 2025 | $25.90 | $32.00 | $40.10 |

| 2026 | $35.00 | $40.00 | $51.90 |

| 2027 | $46.00 | $55.50 | $60.10 |

| 2028 | $55.50 | $59.00 | $67.90 |

| 2029 | $63.20 | $66.00 | $70.00 |

| 2030 | $68.00 | $70.00 | $90.00 |

| 2035 | $130 | $116 | $180 |

| 2040 | $160 | $210 | $240 |

| 2045 | $190 | $245 | $320 |

| 2050 | $340 | $300 | $380 |

| 2055 | $410 | $400 | $470 |

| 2060 | $460 | $530 | $600 |

Since, its listing in the NASDAQ market, the stock price is consistently increasing. The Palantir stock went public through a direct listing on the New York Stock Exchange in September 2020. Since then, its stock has experienced fluctuations in price, as is typical with publicly traded companies. Overall, it has been in an upward direction.

PLTR vs. BRK-B – Performance Comparison: Compare and contrast key facts about Palantir Technologies Inc. and Berkshire Hathaway Inc. Scroll down to visually compare performance, riskiness, drawdowns, and other indicators and decide which better suits your portfolio: PLTR or BRK-B.

Palantir Stock Price Prediction 2023

Palantir has expanded its services to various industries, i.e., healthcare, finance, and energy. The company also offers a product called “Palantir Foundry,” a data integration and management platform designed for commercial enterprises. It is clear that PLTR stock price in 2023 may cross the $18 level with an average of $13.50. The minimum PLTR stock price may be $8.90 in 2023.

Palantir Stock Price Forecast 2024

By 2024, PLTR stock price may be a highly traded stock and may reach as high as $25. Besides that, its lowest trading price may be at $19.40 in 2024. Likewise, the average price may be around $22.50.

Palantir Stock Price Prediction 2025

According to a deep technical analysis of PLTR stock, in 2025 price of PLTR stock is predicted to reach a minimum share of $25.90. In addition, the PLTR stock price may be a maximum of $40.10 with an average trading price of around $32.00.

Palantir Stock Price Prediction 2030

Palantir faces competition from established technology companies and startups that offer data analytics and intelligence solutions. The ability to differentiate its products, maintain pricing competitiveness, and provide unique value propositions may be important for its success.

So, it is predicted that the PLTR stock price during this time may reach a maximum of $90 if the market contains positive trading. Otherwise, the price could go to a minimum of $68, including an average of $68.

Palantir Stock Price Forecast 2035

Palantir’s success may continue in innovating and developing advanced data analytics and intelligence solutions. So, in 2035, the PLTR stock may be initially traded at $130 and go all-time high of $180. The average PLTR stock price may be $116 in 2035.

Palantir Stock Price Prediction 2040

By 2040, Palantir may have established partnerships and contracts with various government agencies and commercial clients. Therefore, market experts predict the future growth and financial performance that PLTR stock may reach $240 in 2040. The minimum PLTR stock price may be $160 in 2040. Likewise, the average PLTR stock price may be $210 in 2040.

Palantir Stock Price Forecast 2045

Market experts predict that the PLTR stock price graph could be upward at $320 and downward at $ 245 this year. If we find the total average price of PLTR stock in 2040, it may be around $190.

Palantir Stock Price Prediction 2050

By 2050, Palantir will have expanded into new industries beyond its traditional focus on government and defense. It may spread its business in sectors such as healthcare, finance, and energy. So, the maximum PLTR stock price in 2050 may be $340 and the minimum price may be $340. Likewise, the average PLTR stock price may be $300 in 2050.

Palantir Stock Price Forecast 2055

If we calculate PLTR Stock Price Prediction 2055, PLTR stock share may climb to $470. If the market scenario is bearish, it is expected that PLTR stock go to $410 on the downside. Moreover, the overall average during the year may be nearly $400.

Palantir Stock Price Prediction 2060

As a company dealing with sensitive data, Palantir operates in a regulatory environment that governs data privacy and security. Adapting to evolving regulations and maintaining compliance will be essential for the company’s operations and reputation. According to stock market experts, till 2060, the maximum price of the PLTR stock may be high at $600 and low at $460. Likewise, the average price of PLTR stock may remain at $530.

From Twitter to Palantir, Losses in Technology Stocks: Twitter Stock shares have lost more than 30% of their value since a March peak, with much of the decline coming after a disappointing revenue forecast. Twitter stock has now fallen in nine of the last 10 trading sessions. Twitter shares closed down 0.04% at $53.79 on Friday with a valuation of 11 times sales.

Palantir Stock Forecast 2023,2024, 2025, 2030, 2040, 2050

Palantir Technologies, known for its advanced data analytics and AI-driven software solutions, has been making waves in the technology industry. This blog will explore the factors influencing Palantir’s stock performance in the coming decades and provide insights into the potential growth trajectory of this promising company. Join us as we analyze the future prospects of Palantir and its potential as a long-term investment.

Background of Palantir Technologies Inc.

Palantir Technologies Inc. is a data analytics company founded in 2003 with the noble objective of providing support for counter-terrorism efforts. Drawing inspiration from J.R.R. Tolkien’s legendary “The Lord of the Rings” trilogy, the company adopted the name “Palantir” to signify its mission of providing visionary insights through data analysis.

Today, Palantir’s cutting-edge software and technology are trusted and utilized by a multitude of government agencies, including intelligence and law enforcement organizations. This demonstrates the company’s commitment to leveraging data to tackle the most pressing global challenges and ensure a safer and more secure future.

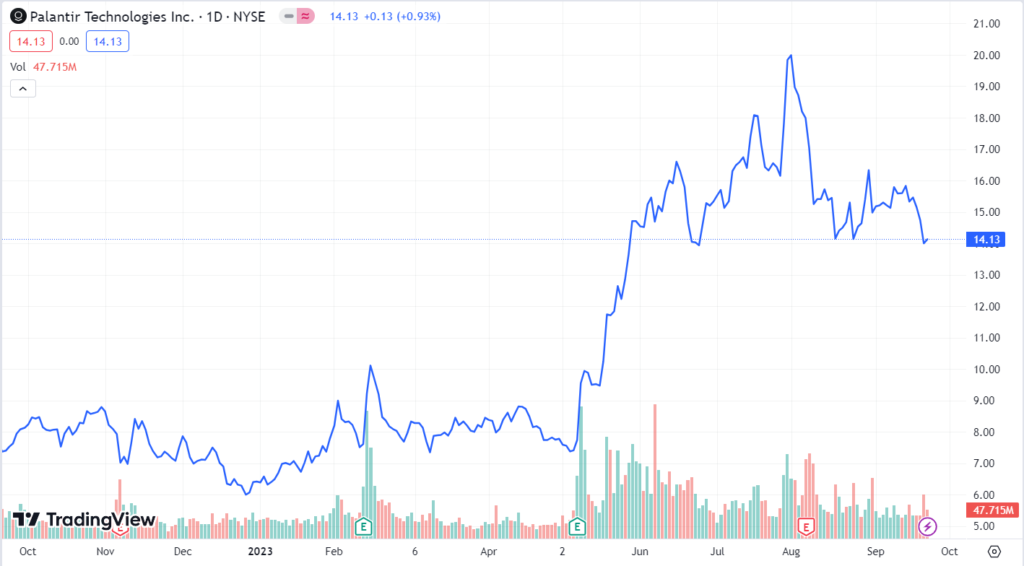

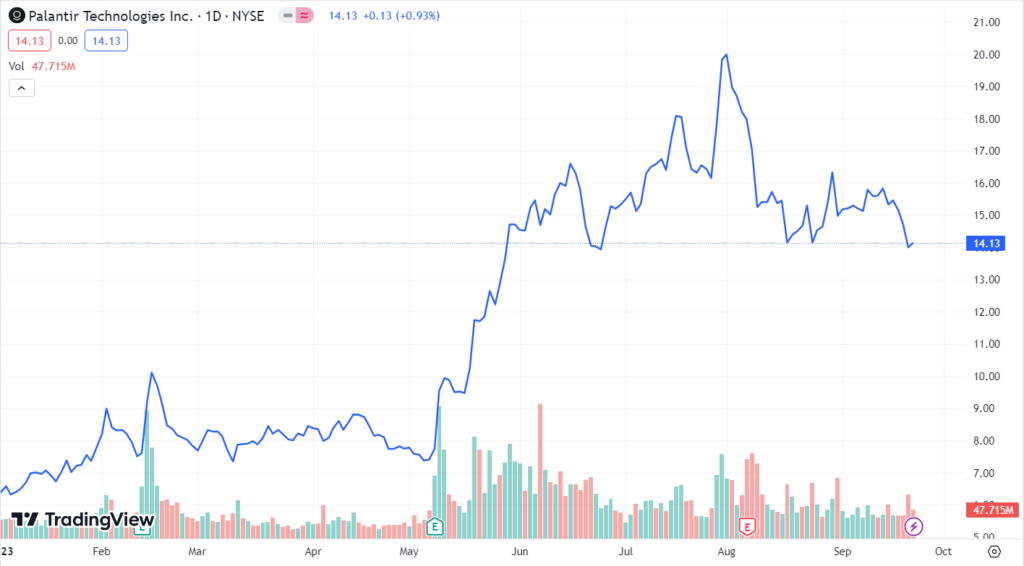

Recent Performance of PLTR Stock

The recent performance of Palantir’s stock has been impressive, with consistent growth in the past year. This consistent growth has instilled a sense of confidence among investors, resulting in a significant increase in the stock’s value.

In fact, Palantir’s stock has outperformed the market, delivering impressive returns to shareholders. This remarkable performance can be attributed to the company’s strong financial performance and positive outlook, both of which have contributed to its recent success.

As a result, Palantir’s stock has become an attractive investment option for those seeking promising returns in the data analytics industry.

| Year | Minimum Stock Price | Maximum Stock Price |

| 2023 | $14.45 | $25.56 |

| 2024 | $42.15 | $51.99 |

| 2025 | $68.34 | $78.59 |

| 2026 | $96.42 | $108.35 |

| 2027 | $118.19 | $142.13 |

| 2028 | $169.07 | $180.79 |

| 2029 | $196.14 | $208.55 |

| 2030 | $223.86 | $238.13 |

| 2035 | $368.02 | $387.64 |

| 2040 | $509.31 | $543.65 |

| 2050 | $856.61 | $885.90 |

Airbnb, Palantir, Roblox, and Roku: Stock Market Weekly Digest: Airbnb Inc. – the company owning a short-term rentals service of the same name – published its quarterly and yearly reports on Tuesday 14 February. The statistics made its shares grow by 31.58% to $143.25.

Palantir Stock Forecast 2023,2024, 2025, 2030, 2040, 2050

Palantir Stock Forecast 2023

Palantir Technologies Inc. is expected to experience significant growth in its stock price in 2023. The increasing demand for Palantir’s data integration and analysis solutions is likely to drive the stock price higher in 2023. Factors such as expanding partnerships and government contracts are anticipated to contribute to Palantir’s stock price growth in 2023.

Market projections indicate that the PLTR stock price may cross the $25.56 level, with an average of $19.80. Even the minimum PLTR stock price is projected to be $14.45 in 2023.

| YEAR | Palantir Stock Price Prediction |

| 2023 | $14.45 to $25.56 |

Palantir Stock Forecast 2024

As businesses and organizations increasingly recognize the value of data-driven decision-making, the demand for Palantir’s data integration and analysis solutions is likely to soar, contributing to positive stock price predictions for 2024. Analysts believe that by 2024, Palantir’s stock may reach as high as $51.99, while the lowest trading price may be around $47.38, with an average price of approximately $42.15.

| YEAR | Palantir Stock Price Prediction |

| 2024 | $42.15 to $51.99 |

Palantir Stock Forecast 2025

As the demand for data analytics and AI technologies continues to grow, Palantir’s advanced software offerings position it well for future success in 2025. In fact, experts predict that in 2025, the price of PLTR stock may reach a minimum share of $68.34. Furthermore, the PLTR stock price may be a maximum of $78.59 with an average trading price of around $72.50.

| YEAR | Palantir Stock Price Prediction |

| 2025 | $68.34 to $78.59 |

Palantir Stock Forecast 2026

The increasing demand for Palantir’s data analytics solutions is projected to be one of the key factors contributing to the positive stock price prediction for 2026. With such optimistic prospects, it is predicted that in 2026, the PLTR stock may be initially traded at $96.42 and go on to reach an all-time high of $108.35. The average PLTR stock price may be around $105.12 in 2026, indicating strong growth potential for investors.

| YEAR | Palantir Stock Price Prediction |

| 2026 | $96.42 to $108.35 |

Palantir Stock Forecast 2027

Palantir’s stock price is anticipated to reach new highs in 2027, according to market analysts. With an increased demand for Palantir’s products and services, the stock price is expected to experience substantial growth. Market trends suggest that the upward trajectory of Palantir’s stock price will continue throughout the year.

In fact, experts predict that the PLTR stock price graph could range from $118.19 to $142.13. Taking into account these projections, the total average price of PLTR stock in 2027 may be around $127.34.

| YEAR | Palantir Stock Price Prediction |

| 2027 | $118.19 to $142.13 |

Palantir Stock Forecast 2028

The strong fundamentals and growth prospects suggest a favorable stock price prediction for Palantir in 2028. If we calculate PLTR Stock Price Prediction 2028, PLTR stock share may climb to $180.79. If the market scenario is bearish, it is expected that PLTR stock go to $169.07 on the downside. Moreover, the overall average during the year may be nearly $173.82.

| YEAR | Palantir Stock Price Prediction |

| 2028 | $169.07 to $180.79 |

Palantir Stock Forecast 2029

Based on current trends and market analysis, Palantir’s stock is expected to experience significant growth in 2029. Factors such as increasing demand for data analysis and Palantir’s strong market position are likely to contribute to the stock price surge in 2029. The company’s innovative product offerings and strategic partnerships are also expected to drive Palantir’s stock price higher in 2029.

According to stock market experts, till 2029, the maximum price of the PLTR stock may be high at $208.55 and low at $196.14. Likewise, the average price of PLTR stock may remain at $102.54.

| YEAR | Palantir Stock Price Prediction |

| 2029 | $196.14 to $208.55 |

Palantir Stock Forecast 2030

As the company continues to expand its customer base and generate substantial revenue, analysts predict that Palantir’s stock price will reach new highs. With its continuous product innovation and strategic partnerships, Palantir is well-positioned to experience a positive stock price trajectory.

If the market contains positive trading, it is predicted that the PLTR stock price during this time may reach a maximum of $238.13. However, if the market scenario is bearish, the price could go as low as $223.86, with an average of $229.27.

| YEAR | Palantir Stock Price Prediction |

| 2030 | $223.86 to $238.13 |

Palantir Stock Forecast 2040

The year 2040 holds great potential for Palantir’s stock price, as experts predict a significant growth trajectory. This can be attributed to the increasing demand for Palantir’s data analytics and intelligence platforms, which are expected to contribute to the rise in its stock price.

According to market experts, the projected range for PLTR stock in 2040 is between $509.31 and $543.65, with an average price of $527.24.

| YEAR | Palantir Stock Price Prediction |

| 2040 | $509.31 to $543.65 |

Palantir Stock Forecast 2050

Experts predict that Palantir’s stock price will continue to rise steadily over the next 30 years. With a strong growth potential and a positive stock price outlook, Palantir is expected to perform well in the stock market.

Several factors, such as technological advancements and the increasing demand for data analytics, are likely to contribute to the company’s stock price growth. This makes Palantir an attractive option for long-term investors.

Looking ahead to 2050, market projections suggest that the maximum price for PLTR stock may reach $885.90, while the minimum price could be $856.61. The average stock price for Palantir in 2050 is estimated to be around $872.34.

| YEAR | Palantir Stock Price Prediction |

| 2050 | $856.61 to $885.90 |

Palantir, Uber Among Pack Of Top Trending Stocks: Uber Technologies Inc. UBER increased by 2.74% to close at $49.46. The stock’s intraday high was $49.49 and the low was $48.15. The 52-week range is between $22.89 and $49.49. Uber Stocks maintains a competitive edge with lower prices and shorter wait times, according to DA Davidson analyst Tom White.

Will Palantir Hit $100?, Frequently Asked Questions (FAQs)

Where will Palantir Stock be in 5 years?

After the next five years, Palantir’s stock price can be seen at around $53 to $58.

Is it a good time to buy Palantir Stock?

According to the stock market calculator, the Palantir Stock is a buy at this price, provided that a stop loss of $12.20 is used.

Will Palantir Stock hit $100?

Palantir’s stock price is currently trading well below $100. It will take a long time for Palantir’s stock to reach $100. According to our analysis, Palantir stock can reach $100 by the year 2033.

What will Palantir be worth in 5 years?

Palantir is a growing software industry where we may see a 15% revenue growth in the upcoming five years. If Palantir successfully maintains the stock revenue, revenue may touch nearly $60 billion by 2028.

What is the future potential of Palantir?

If Palantir expands its software platforms into other industries beyond government and defense, Palantir have a great future. It includes various sectors like healthcare, finance, energy, and manufacturing, where data analysis and decision support systems are becoming increasingly important.

Why you should buy Palantir Stock?

Palantir’s Stock strengths include its advanced data analytics technology, strategic partnerships with government agencies and large companies, and a growing customer base across various industries.

In addition, the company’s diversified revenue streams and focus on long-term contracts provide a stable financial foundation.

Is Palantir’s Stock a good long-term investment?

However, some investors consider Palantir to have strong long-term potential due to its advanced data analytics technology, strategic partnerships, growing customer base, and diversified revenue streams.

On the other hand, there are concerns about the company’s reliance on government contracts, its unpredictable growth due to long-term individual contracts, and market volatility. Maybe we should go ahead with technical levels.

Is Palantir a good stock to buy?

Palantir Technologies has shown strong growth potential in recent years, attracting attention from investors seeking promising opportunities.

The company’s innovative technology and reliable data analytics services have established its position as a leader in the industry. As a result, analysts predict that Palantir’s stock will continue to perform well in the coming years.

Is Palantir Overvalued?

Palantir’s stock valuation has been a subject of debate, with some analysts arguing that it is overvalued. Factors contributing to the perceived overvaluation include the company’s high price-to-earnings ratio and its reliance on government contracts.

However, supporters of Palantir argue that its unique technology and growing customer base justify its current valuation.

Is Palantir a risky stock?

Palantir’s stock has shown a high level of volatility in the past, making it potentially risky for investors. This volatility can be attributed to a variety of factors, including market fluctuations and investor sentiment.

Is there a future for Palantir?

Palantir is expected to have a bright future based on its strong financial performance and continuous technological advancements.

The company’s innovative data analytics solutions have gained significant traction in the market, attracting a growing customer base across various industries.

Industry experts predict that Palantir’s stock will continue to grow steadily in the coming years, thanks to its robust product offerings and the increasing demand for advanced data analytics tools.

Is Palantir a buy, sell, or hold?

Many analysts consider Palantir a buy, as the company continues to gain traction in multiple industries and expand its customer base. This indicates that there is significant market potential for their products, which bodes well for the company’s future performance.

On the other hand, some experts have a cautious stance and believe that Palantir is a sell at its current valuation. They raise concerns about competition in the industry and question whether Palantir can sustain its high growth rate.

Is Palantir a good long-term stock?

Yes, Palantir is considered a good long-term stock because of its strong financial performance and consistent growth. The company has demonstrated its ability to generate profits over the years, which reflects its solid financial foundation.

Palantir has a solid track record of delivering innovative products and services, making it a promising long-term investment.