Crypto And Blockchain Billionaires: Blockchain is the technology that enables the existence of cryptocurrency. Bitcoin is the name of the best-known cryptocurrency, the one for which blockchain technology, as we currently know it, was created.

A cryptocurrency is a medium of exchange, such as the US dollar, but is digital and uses cryptographic techniques and it’s the protocol to verify the transfer of funds and control the creation of monetary units.

The Richest Crypto And Blockchain Billionaires Are As Follows:

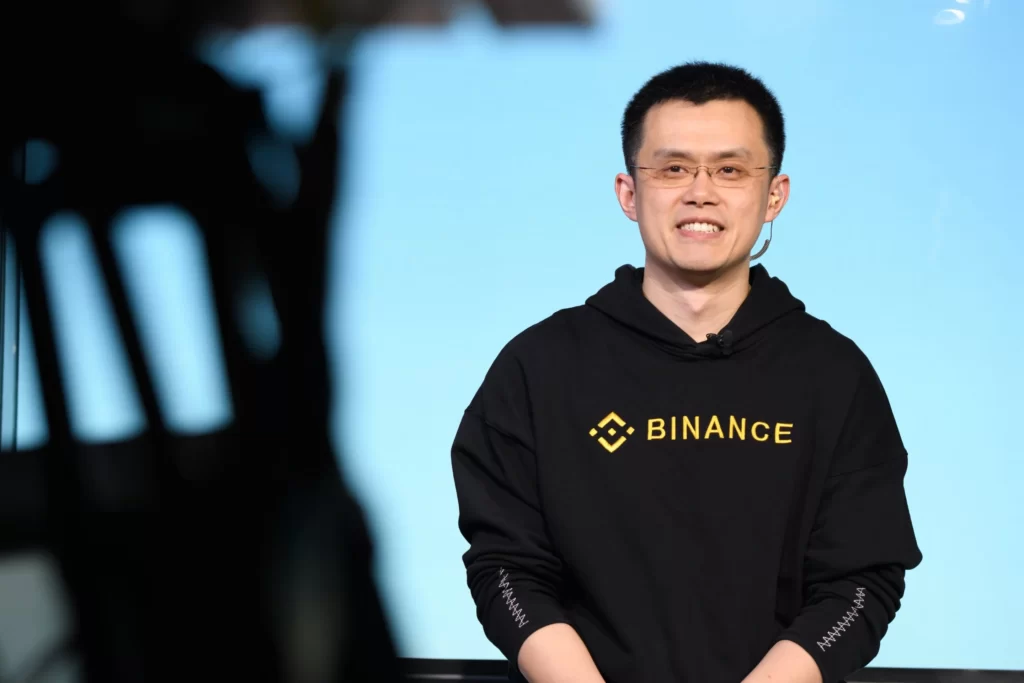

1. Changpeng Zhao

- Net worth: $65 billion

- Source of wealth: Binance

- Citizenship: Canada

Crypto And Blockchain Billionaires: Crypto’s richest person, Binance founder, and CEO “CZ” is the 19th richest person in the world. Forbes estimates that he owns at least 70% of Binance, the leading global platform for crypto trading. Last year, the company reportedly facilitated about two-thirds of all trading volume handled by centralized changes, generating estimated revenue north of $16 billion. Based on those estimates, Forbes raised its evaluation of CZ’s wealth from $1.9 billion last year. The 44-year-old also holds a small chunk of Bitcoin and an undisclosed amount of BNB, Binance’s native token. Binance plans to make a major investment in the parent company that will own Forbes following Forbes’ previously-announced public listing transaction.

2. Sam Bankman-Fried

- Net worth: $24 billion

- Source of wealth: FTX

- Citizenship: U.S.

Crypto And Blockchain Billionaires: The 30-year-old moved from Hong Kong to the more crypto-friendly Bahamas in late 2021 alongside his exchange FTX, which raised $400 million in January at a $32 billion valuation. The startup’s backers include crypto VC shop Paradigm (headed by Coinbase founder Fred Ehrsam, another crypto billionaire), venture capital firm Sequoia, buyout firm Thoma Bravo and the Ontario Teachers’ Pension Plan Board. FTX’s U.S. operations were also recently valued by investors, at $8 billion. A professed adherent of effective altruism–the utilitarian-inflected notion of doing the best possible–Bankman-Fried has vowed to give away his entire fortune over his lifetime. He owns around half of FTX and more than $7 billion worth of FTT, the platform’s native token.

3. Brian Armstrong

- Net worth: $6.6 billion

- Source of wealth: Coinbase

- Citizenship: U.S.

Crypto And Blockchain Billionaires: The CEO and founder of Coinbase took the crypto exchange public through a direct listing in April 2021 at a stunning $100 billion valuation. Its market capitalization is about half that today, but still good enough to make Armstrong–with his 19% stake–the third wealthiest person in crypto. A recognizable figure for his plain T-shirts and bald pate, Armstrong raised eyebrows in 2020 after demanding his employees refrain from political discussion at work. In January, the 39-year-old dropped $133 million on a Bel-Air mansion, one of the city’s priciest home transactions to date. More recently, Armstrong has been advocating against the EU Parliament’s proposed crypto legislation.

4. Gary Wang

- Net worth: $5.9 billion

- Source of wealth: FTX

- Citizenship: U.S.

Crypto And Blockchain Billionaires: The co-founder and chief technology officer of FTX, the press-shy Wang launched the crypto exchange with Bankman-Fried in 2019. Wang holds a 16% stake in FTX’s global business and over $600 million worth of FTT, the native token of FTX. Before going into crypto, Wang was a software engineer at Google, where he helped build the online booking platform Google Flights. He studied math and computer science at MIT.

5. Chris Larsen

- Net worth: $4.3 billion

- Source of wealth: Ripple

- Citizenship: U.S

Crypto And Blockchain Billionaires: The co-founder and executive chairman of blockchain company Ripple, whose XRP token is currently the 8th largest cryptocurrency, Larsen has kept busy fighting against a Securities and Exchange Commission lawsuit–first filed in December 2020–that alleges Ripple’s initial coin offering was an unlawful offer and sale of unregistered securities. Still winding its way through federal courts, the case is perceived by many crypto watchers as a landmark one for future token sales. Larsen and Ripple have denied wrongdoing. Separate from his legal challenges, the 61-year-old Larsen has partnered with climate groups to launch a campaign–“Change the Code, Not the Climate”–to pressure the Bitcoin community to reduce the digital asset’s heavy carbon footprint.

6. Cameron Winklevoss and Tyler Winklevoss

- Net worth: $4 billion each

- Source of wealth: Bitcoin

- Citizenship: U.S.

Crypto And Blockchain Billionaires: The twin brothers–best known as Mark Zuckerberg’s college nemeses (as immortalized in the Hollywood film The Social Network)–have turned their $65 million settlement with Zuck into digital gold, amassing crypto fortunes of roughly $4 billion apiece. The siblings, who began buying bitcoin in 2012, have since diversified their digital assets portfolios, acquiring other cryptocurrencies and launching the crypto exchange Gemini. The duo also owns the digital art auction platform Nifty Gateway, a beneficiary of last year’s NFT craze.

7. Song Chi-Hyung

- Net worth: $3.7 billion

- Source of wealth: Upbit

- Citizenship: South Korea

Crypto And Blockchain Billionaires: The founder of South Korea’s leading crypto exchange, Upbit, Chi-hyung has cashed in on South Korea’s booming, $46 billion crypto market. He’s estimated to own about a quarter of Upbit’s parent company, Dunamu, which was valued at $17 billion last November when Hybe, the agency behind K-pop sensation BTS, bought a 2.5% stake. Qualcomm, the U.S. semiconductor giant, previously held 6% of Dunamu.

8. Barry Silbert

- Net worth: $3.2 billion

- Source of wealth: Digital Currency Group

- Citizenship: U.S.

Crypto And Blockchain Billionaires: The founder of the investment group Digital Currency Group, Silbert has built a diversified crypto conglomerate. His investment firm controls Grayscale, which manages some $28 billion of crypto assets, as well as CoinDesk, a popular crypto news and events company. Through numerous subsidiaries, Silbert’s DCG has invested in more than 200 crypto startups. Prior to crypto, Silbert was an investment banker and entrepreneur who sold the stock trading platform Second Market to Nasdaq in 2015 for an undisclosed amount.

9. Jed McCaleb

- Net worth: $2.5 billion

- Source of wealth: Ripple, Stellar

- Citizenship: U.S.

Crypto And Blockchain Billionaires: McCaleb made most of his fortune from Ripple Labs and XRP, the payments-focused cryptocurrency project he cofounded in 2012; McCaleb left the project in 2013 after a falling out with Larsen and other team members. Since then, McCaleb has sold much of his XRP in periodic increments, adhering to a 2014 separation agreement he struck with Ripple Labs. He’s the founder and chief technology officer of the cryptocurrency Stellar.

10. Nikil Viswanathan and Joseph Lau

- Net worth: $2.4 billion each

- Source of wealth: Alchemy

- Citizenship: U.S. (both)

Crypto And Blockchain Billionaires: The co-founders of blockchain decacorn Alchemy, Viswanathan and Lau first met in 2011 at Stanford while serving as TAs for a computer science class; they have since built over 10 products together. Their first hit, the meetup app Down To Lunch, was briefly the Apple App Store’s top social networking app in April 2016. After discovering crypto, the duo started Alchemy in 2017 as a toolkit for blockchain entrepreneurs and developers. Today, Alchemy is a leading development platform for Web3 applications, including NFT powerhouse OpenSea and decentralized exchange Kyber. In February, the company raised $200 million at a $10.2 billion valuation, less than four months after it was valued at $3.5 billion in a fundraising round.

11. Devin Finzer and Alex Atallah

- Net worth: $2.2 billion

- Source of wealth: OpenSea

- Citizenship: U.S. (both)

Crypto And Blockchain Billionaires: The 30-somethings cofounded blockchain startup OpenSea, an early player in the booming NFT market. OpenSea serves as a peer-to-peer platform for users to create, buy and sell non-fungible tokens. In 2018, the duo entered the Y Combinator accelerator program with the idea of paying people in crypto to share their Wi-Fi hotspots. After discovering CryptoKitties–the Ethereum-run collectibles which attracted a cult-like following–they pivoted to the idea of a marketplace for nascent NFTs, which exploded in popularity last year. OpenSea raised capital in January at a $13.3 billion valuation—up from $1.5 billion just six months earlier. Finzer and Atallah each hold an estimated 18.5% stake in the company.

12. Fred Ehrsam

- Net worth: $2.1 billion

- Source of wealth: Coinbase

- Citizenship: U.S.

Crypto And Blockchain Billionaires: A co-founder of Coinbase, Ehrsam now runs Paradigm, which invests mainly in crypto companies and new tokens. In January, Paradigm invested in Citadel Securities, one of the largest market-makers in U.S. equity trading markets. The 34-year-old Ehrsam left Coinbase in 2017 but remains on the board and still holds a 6% stake in the company. Before discovering crypto, Ehrsam worked as a foreign exchange trader at Goldman Sachs. The young mogul partly credits his crypto success to being a “hardcore gamer” in high school.

13. Kim Hyoung-nyon

- Net worth: $1.9 billion

- Source of wealth: Upbit

- Citizenship: South Korea

Crypto And Blockchain Billionaires: The executive vice president of South Korea’s Dunamu, Hyoung-nyon owns an estimated 13% of South Korea’s leading crypto exchange, which he co-founded a decade ago with fellow crypto billionaire Song Chi-hyung.

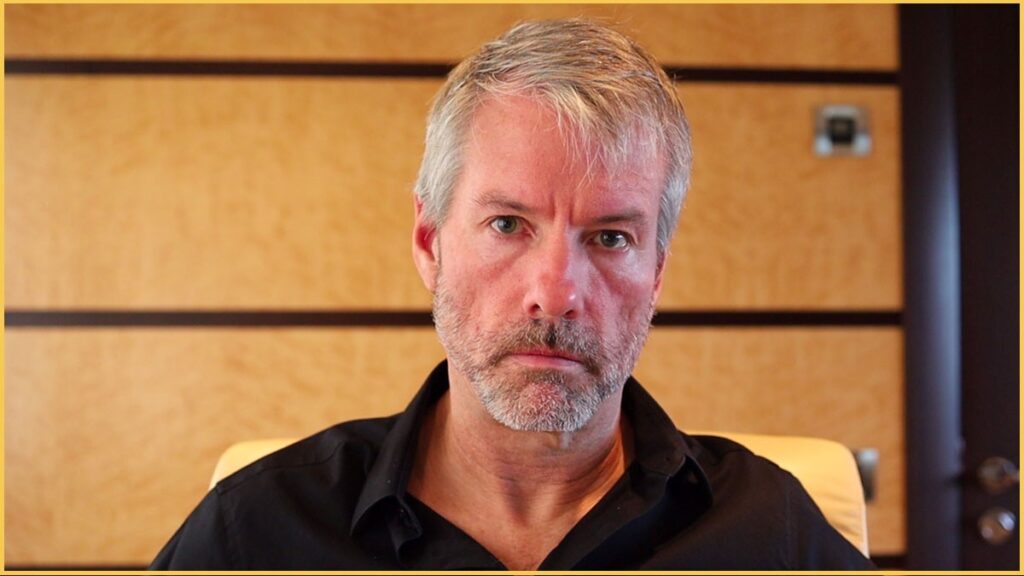

14. Michael Saylor

- Net worth: $1.6 billion

- Source of wealth: MicroStrategy

- Citizenship: U.S.

Crypto And Blockchain Billionaires: Saylor has turned MicroStrategy, the business software company he cofounded in 1989, into a Bitcoin proxy. In 2020 alone, the crypto enthusiast oversaw MicroStrategy’s purchase of over 70,000 bitcoins–at a cost of roughly $1.1 billion–using cash reserves and borrowed funds. The bet has paid off as Bitcoin’s value has soared. MicroStrategy’s stock has quadrupled in the last two years, returning Saylor to the three-comma club. (A dot-com era billionaire, the 57-year-old Saylor saw his fortune plummet during the dot-com crash and in the wake of an accounting scandal.) Ever hungry for bitcoin, Saylor’s MicroStrategy announced in late March that it took on a $205 million loan to buy more of the leading cryptocurrency.

15. Matthew Roszak

- Net worth: $1.4 billion

- Source of wealth: Bitcoin, other cryptocurrencies

- Citizenship: U.S.

Crypto And Blockchain Billionaires: Roszak began buying bitcoin in 2012 and participated in early initial coin offerings, buying up tokens such as Mastercoin, Factom, and Maidsafe in 2013. Roszak has also invested in various crypto startups, including popular exchanges Coinbase and Kraken. Prior to crypto, Roszak worked as a venture capitalist at firms like SilkRoad Equity (where he settled SEC charges of insider trading) and in private equity for Advent International in the United Kingdom. A true believer, Roszak recently co-led an initiative to give every member of Congress $50 worth of digital assets and says he gave Richard Branson and Bill Clinton their first bitcoins.

Blockchain also has potential applications far beyond bitcoin and cryptocurrency.

Bitcoin and Cryptocurrency: From a business perspective, it’s helpful to think of blockchain technology as a type of next-generation business process improvement software. Collaborative technology, such as blockchain, promises the ability to improve the business processes that occur between companies, radically lowering the “cost of trust.” For this reason, it may offer significantly higher returns for each investment dollar spent than most traditional internal investments.

Financial institutions are exploring how they could also use blockchain technology to upend everything from clearing and settlement to insurance. These articles will help you understand these changes and what you should do about them.

Bitcoin and Cryptocurrency: For an overview of cryptocurrency, start with Money as no object. We explore the early days of bitcoin and provide survey data on consumer familiarity, usage, and more. We also look at how market participants, such as investors, technology providers, and financial institutions, will be affected as the market matures.

For a deeper dive into cryptocurrencies, we recommend that you read the following:

● Crypto Center: PwC’s open source of knowledge on all things crypto.

● Carving up crypto provides an overview of how regulators are thinking about cryptocurrency in financial services, both in the United States and abroad.

● Cryptocurrency? Digital asset? What’s the accounting? In this podcast, we discuss what these terms mean and how they impact your financial statements.

● For board members, Ten questions every board should ask about cryptocurrencies suggests questions to consider when engaging in a conversation about the strategic potential of cryptocurrencies.

For an overview of blockchain in financial services

Bitcoin and Cryptocurrency: We examine some of the ways FS firms are using blockchain, and how we expect blockchain technology to develop in the future. Blockchain isn’t a cure-all, but there are clearly many problems for which this technology is the ideal solution.

● A strategist’s guide to blockchain examines the potential benefits of this important innovation—and also suggests a way forward for financial institutions. Explore how others might try to disrupt your business with blockchain technology, and how your company could use it to leap ahead instead.

● Building blocks: How financial services can create trust in blockchain discusses some of the issues internal audit and other parties may have with a blockchain solution, and how you can start to overcome some of those concerns.

Bitcoin and Cryptocurrency: Blockchain announcements continue to occur, although they are less frequent and happen with less fanfare than they did a few years ago. Still, blockchain technology has the potential to result in a radically different competitive future for the financial services industry.

Check Also: Top 10 NFT Marketplaces in [year]

Frequently Asked Questions (FAQs)

How are people getting rich from crypto?

HODLing – Invest in Crypto and Hold on a Long-Term Basis. Staking and Interest – Earn Passive Income on Idle Crypto Holdings. Play-to-Earn Crypto Games – Earn Crypto Rewards by Playing Blockchain Games. Crypto Yield Farming & Lending – Generate Income by Loaning Crypto Tokens.

Which crypto billionaire lost all money?

Binance founder and CEO Changpeng Zhao was the crypto billionaire who lost the most money following the crypto crisis of 2022, with a net worth drop amounting to 82 billion U.S. dollars.

Do rich people control crypto?

Those top players represent a mere 0.01% of all bitcoin holders and yet they control 27% of the digital currency, the Wall Street Journal reported. That compares to the old-fashion dollar, where the top 1% controlled 30% of total U.S. household wealth, according to Federal Reserve data.

How many people lost their money in crypto?

Overall, back-of-the-envelope calculations suggest that around three-quarters of users have lost money on their Bitcoin investments.”

Who owns the majority of crypto?

Out of the surveyed owners, over 70% of them have an annual income above USS1 million, and 33% of them with income between US$500,000 and US$999,999. The majority of US cryptocurrency owners are in the 18-44 age group (58%). 5% of them are 55 and above.

Who is in control of crypto?

Cryptocurrencies typically use decentralized control as opposed to a central bank digital currency (CBDC). When a cryptocurrency is minted, created prior to issuance, or issued by a single issuer, it is generally considered centralized.

Who is the man behind crypto?

Vitaly “Vitalik” Buterin (born 1994) is a Russian-Canadian computer programmer and founder of Ethereum. Buterin became involved with cryptocurrency early in its inception, co-founding Bitcoin Magazine in 2011.