Boil Stock Forecast 2025: BOIL is a leveraged ETF, and like all geared products, is intended to be held only for short periods, it’s not appropriate for buy-and-hold investors. BOIL provides 2x the return of a futures-based natural gas index daily. Daily compounding of returns can lead to the fund’s returns varying significantly from the 2x exposure to the index over longer holding periods. Index returns reflect both the price changes on its futures contracts as well as any gain or loss from “rolling” those futures contracts. BOIL is a tactical tool, so trading costs and volume matter.

Boil Stock Price Prediction: An Overview

Boil Stock Price Prediction: Investors are constantly seeking opportunities to maximize their returns in the stock market, and one stock that has garnered significant attention is Boil. Boil, ProShares Ultra Bloomberg Natural Gas is a company in the energy sector that specializes in the exploration, development, and production of oil and gas resources. As the global energy demand continues to rise, predicting the future performance of Boil stock becomes crucial for investors. In this article, we will provide an in-depth analysis of Boil stock price predictions for the years 2024, 2025, and 2030.

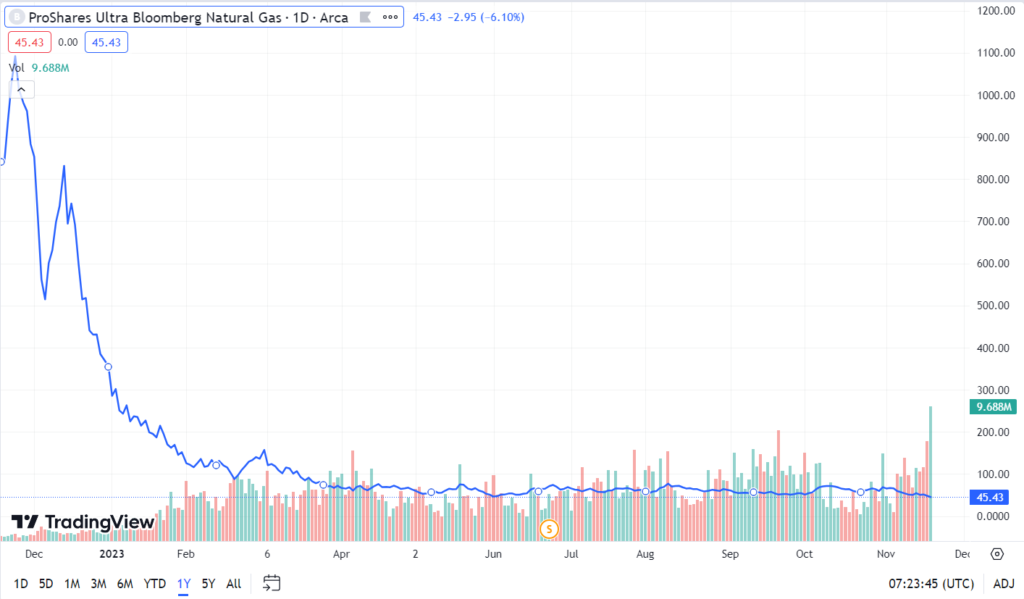

Contango is also the primary reason why the exchange-traded funds ProShares Ultra Bloomberg Natural Gas (ticker: BOIL) and United States Natural Gas Fund LP (UNG) have drastically underperformed the commodity itself this year. Both of those ETFs invest in U.S. natural gas futures. Although they do so in different ways, both have lost substantially more than front-month natural gas futures, which are down 30.6% in 2023 through Nov. 14.

Facts About Boil Stock Price Prediction

- BOIL is an exchange-traded fund (ETF) designed to produce returns equal to twice the daily performance of the Bloomberg Natural Gas Subindex.

- Currently, BOIL’s underlying index tracks the September 2023 gas futures and will roll to the November contract in August and the January 2024 contract in October.

- The longer-term outlook for gas prices is bullish, but the short-term prospects are mixed and prices for November 2023 and January 2024 futures already reflect significant price upside.

- BOIL suffers from compounding risk meaning that while daily returns will track twice those of the underlying index, returns over longer holding periods can deviate from the benchmark significantly.

- Summer heat drives gas demand for electricity generation, but we’re running out of time for the weather to improve the supply/demand balances for gas this summer.

How to buy BOIL ETF on Public

How to buy BOIL ETF on Public: The following are the steps help to How to buy BOIL ETF on Public

Step 1: Sign up for a brokerage account on Public

It’s easy to get started. You can sign up for an account directly on our website or by downloading the Public app for iOS or Android.

Step 2: Add funds to your Public Account

There are multiple ways to fund your Public account—from linking a bank account to depositing with a debit card or wire transfer.

Step 3: Choose how much you’d like to invest in BOIL ETF

Navigate to the Explore page. Then, type BOIL into the search bar. When you see BOIL ETF appear in the results, tap it to open up the purchase screen.

Step 4: Manage your investments in one place

You can find your newly purchased BOIL ETF in your portfolio—alongside the rest of your stocks, ETFs, crypto, treasuries, and alternative assets.

Boil Stock vs Carnival Stock: Carnival is composed of two companies – Panama-incorporated, US-headquartered Carnival Corporation, and UK-based Carnival plc – which function as one entity.

Some Points To Know About Boil Stock

Boil Stock Price Prediction 2023 I Boil Stock Forecast 2023

Various factors influence the stock price of Boil, and it is essential to consider them while making predictions. Firstly, fluctuations in global oil and gas prices significantly impact Boil’s stock price. As a company operating in the energy sector, any changes in the supply and demand dynamics of oil and gas can affect Boil’s profitability and investor sentiment. Additionally, geopolitical tensions, environmental regulations, and technological advancements in renewable energy can also influence the stock price of Boil.

Boil Stock Price Prediction 2024 I Boil Stock Forecast 2024

For ProShares Ultra Bloomberg Natur Stock (BOIL) price forecast for 2024, the average price target for ProShares Ultra Bloomberg Natur Stock is $62.97 with a high forecast of $117.58 and a low forecast of $8.3558. The average BOIL price prediction of 2024 represents a +78.96% increase from the last price of $45.43.

To predict the future performance of Boil stock, it is crucial to analyze its historical performance. In 2024, Boil reported impressive financial results, with a significant increase in revenue and profitability. This was mainly driven by higher oil and gas prices, increased production, and cost optimization measures implemented by the company. As a result, the stock price of Boil experienced a steady upward trend throughout 2024, providing positive returns to investors.

Boil Stock Price Prediction 2025 I Boil Stock Forecast 2025

ProShares Ultra Bloomberg Natur Stock (BOIL) is expected to reach an average price of $135.82 in 2025, with a high prediction of $170.09 and a low estimate of $101.54. This indicates an +236.77% rise from the last recorded price of $45.43.

Based on the analysis of market trends and Boil’s performance in 2024, industry experts predict a positive outlook for Boil stock in 2025. With the global economy recovering from the pandemic-induced slowdown, the demand for oil and gas is expected to rebound. Moreover, Boil has made strategic investments in exploration and production activities, positioning itself for future growth. These factors, coupled with favorable market conditions, are likely to drive the stock price of Boil higher in 2025.

Boil Stock Price Prediction 2026 I Boil Stock Forecast 2026

The 2026 price forecast for ProShares Ultra Bloomberg Natur Stock (BOIL) stands at an average of $128.53. Projections range from a high of $155.44 to a low of $101.63, signifying an +115.87% increase from the previous price of $45.43.

Looking ahead to 2026, the performance of Boil stock is expected to be influenced by several factors. One key factor is the company’s ability to successfully execute its expansion plans. Boil has identified new oil and gas reserves and aims to increase its production capacity. If the company can deliver on these plans, it is likely to enhance its profitability and investor confidence, leading to a positive impact on the stock price. Additionally, maintaining a stable oil and gas market environment and favorable regulatory policies will be crucial for Boil’s stock performance in 2026.

Boil Stock Price Prediction 2027 I Boil Stock Forecast 2027

For 2027, the average price target for ProShares Ultra Bloomberg Natur Stock (BOIL) is $55.35, with a high forecast of $104.68 and a low forecast of $6.0234. This indicates an +33.11% increase from the last price of $45.43.

As we delve further into the future, predicting stock prices becomes more challenging. However, based on the industry outlook and Boil’s historical performance, it is possible to make some predictions for 2027. By this time, renewable energy sources are expected to gain significant traction, potentially impacting the demand for fossil fuels. Boil’s ability to adapt to changing market dynamics and invest in renewable energy technologies will play a crucial role in determining its stock price trends in 2027.

Boil Stock Price Prediction 2028 I Boil Stock Forecast 2028

ProShares Ultra Bloomberg Natur Stock (BOIL) is estimated to achieve an average price of $38.49 in 2028, with a high projection of $74.97 and a low estimate of $2.0054. This suggests an +44.69% rise from the preceding price of $45.43.

Boil Stock Price Prediction 2029 I Boil Stock Forecast 2029

The 2029 price forecast for ProShares Ultra Bloomberg Natur Stock (BOIL) is $154.21 on average, with a high prediction of $308.29 and a low estimate of $0.127. This represents an +617.57% increase from the previous price of $45.43.

Boil Stock Price Prediction 2030 I Boil Stock Forecast 2030

ProShares Ultra Bloomberg Natur Stock (BOIL) is expected to reach an average price of $341.98 in 2030, with a high forecast of $370.96 and a low forecast of $313.01. This signifies a +707.26% surge from the last price of $45.43.

Looking towards the long-term future, the year 2030 holds immense potential for Boil’s stock price. With the world transitioning towards cleaner and more sustainable energy sources, Boil’s success will largely depend on its ability to diversify its energy portfolio. Investing in renewable energy projects and actively participating in the energy transition can position Boil as a leader in the industry. If successful, this can drive the stock price of Boil higher, providing lucrative returns for investors.

Boil Stock vs Walmart Stock: Based on analyst ratings, Walmart’s 12-month average price target is $181.64. Walmart has a 16.92% upside potential, based on the analysts’ average price target. Walmart has a consensus rating of Strong Buy which is based on 25 buy ratings, 4 hold ratings, and 0 sell ratings.

Evaluating Boil Stock Growth Potential: Boil Stock Price Prediction 2025

Analyzing Boil’s growth potential is crucial for predicting its stock price. The company’s strategic investments in exploration, production, and diversification of energy sources indicate a positive growth trajectory. Additionally, Boil’s strong financial position and efficient operations provide a solid foundation for future growth. By considering these factors, investors can make informed decisions about the growth potential and stock price of Boil.

Market Analysis: Boil Stock Price Prediction 2025

Market analysis plays a vital role in predicting the stock price of Boil. A comprehensive assessment of global oil and gas trends, demand-supply dynamics, and competitor analysis can help investors gauge the future performance of Boil. Moreover, tracking macroeconomic indicators and geopolitical developments is essential to identify potential risks and opportunities that may impact Boil’s stock price.

Expert Opinions on Boil Stock Price Prediction 2025

Expert opinions can provide valuable insights into the future performance of Boil stock. Financial analysts and industry experts often publish reports and forecasts based on their analysis of various factors influencing the stock market. By considering these expert opinions, investors can gain a more comprehensive understanding of the potential stock price trajectory of Boil.

Risks and Uncertainties in Boil Stock Forecast 2025

It is essential to acknowledge the risks and uncertainties associated with predicting stock prices. Factors such as unexpected shifts in global oil and gas prices, geopolitical tensions, and regulatory changes can significantly impact Boil’s stock price. Market volatility and investor sentiment can also introduce uncertainties. Therefore, investors should exercise caution and diversify their portfolios to mitigate potential risks.

Conclusion: Insights into Boil Stock Price Prediction 2025

Predicting the future performance of stocks is an intricate process that involves analyzing multiple factors and considering expert opinions. Boil, being in the energy sector, is subject to various influences that impact its stock price. By examining historical performance, evaluating growth potential, and considering market analysis and expert opinions, investors can gain valuable insights into Boil’s stock price predictions for the years ahead. However, it is crucial to remember that predicting stock prices involves inherent uncertainties, and investors should exercise diligence and prudence in their investment decisions.

In conclusion, Boil’s stock price prediction for the years 2024, 2025, and 2030 is influenced by various factors, including global oil and gas prices, geopolitical tensions, and the company’s growth potential. Analyzing Boil’s historical performance, evaluating its growth prospects, and considering expert opinions and market analysis can provide valuable insights into its stock price predictions.

Boil Stock vs Starbucks Stock: Starbucks Corporation analysts have been active ahead of the company’s fourth-quarter 2021 earnings print scheduled for Oct. 28 after the markets close. They can’t seem to agree on the stock’s value, however.

Lessons From BOIL and UNG Funds in 2024

Boil Stock Forecast 2025: Natural gas prices have slumped in 2023 amid relatively mild temperatures last winter and similar expectations for this winter, meaning people will need to use less natural gas to heat their homes. Record production after a 2022 surge in prices linked to the Russia-Ukraine war and inventories that have been above average have also contributed to price declines, with an outage at a major liquefied natural gas export terminal adding to domestic inventories.

Specialized Commodities ETFs Can Be Volatile

Commodities are notoriously volatile investments, which means that they can be riskier than stocks and bonds even when not packaged in specialized ETFs that can magnify losses. They’re not only subject to the supply and demand cycles of the economy, but they’re also vehicles for trader speculation, which can magnify volatility.

Natural gas is one of the most volatile commodities. Each year, its prices swing back and forth because of actual and expected winter and summer weather, with the commodity used to heat homes in the winter and cool them in the summer. Cooler-than-expected summers mean less demand, as do warmer-than-expected winters.

In addition to weather, economic growth or contraction, production, and storage, the international market also affects natural gas prices. For example, the war in Ukraine caused Europe to look for alternatives to Russian natural gas at a time when inventories needed refilling, helping boost liquefied natural gas exports from the U.S. and contributing to higher domestic natural gas prices.

Commodities can be a good choice for hedging against inflation because rising prices often accompany economic growth and an increasing demand for goods that use these natural resources. But because of the volatility that also accompanies commodities, it’s best to keep these holdings as a relatively small part of your portfolio.

Natural Gas Futures ETFs Roll Over Contracts

Futures contracts were created so that commodities companies could hedge the volatility of their products. For example, a natural gas production company can use futures contracts to lock in a price for future production, which is good for the company if prices decline but also means the company won’t realize gains if prices rise beyond the contract value.

Speculators also use futures markets to make bets on whether commodities prices will rise or fall. Buying and selling futures contracts involves complexities including margin, or being able to control a large contract with only a small percentage of its total value. Futures investors also have to deal with contract expiration, which can mean a choice between cashing out with a gain or loss, taking delivery of the physical commodity, or rolling over the contract into another month.

Natural Gas Futures ETFs Are for Short-Term Bets

Here’s where contango comes in. Because the futures contract that expires further out is often more expensive than the one the funds are holding, the funds lose money on that rollover.

Because these funds are almost always losing value, buying and holding futures-based funds like UNG or BOIL doesn’t make sense as a long-term play on a commodity. This is one of the key reasons why the funds have underperformed the price of natural gas.

Leverage Cuts Both Ways

So why would anybody want to hold these funds? Well, they are designed specifically for those who want to make a short-term bet on natural gas prices without the hassle of buying or selling futures contracts themselves. UNG invests in front-month futures contracts for natural gas and other petroleum-based fuels that are traded on the New York Mercantile Exchange, or NYMEX, and it can invest in forwards and swaps. It rolls expiring near-month contracts over to the next month.

BOIL invests in natural gas futures contracts in a similar way to UNG, but BOIL uses leverage to offer twice the daily movement of a sub-index that tracks natural gas prices. That doubling makes BOIL a useful tool for, say, a short-term trader who wants to make a bullish bet on natural gas and double their money. But remember that the leverage cuts the other way, too. That heightened volatility coupled with a daily compounding of returns means that this fund isn’t suitable for long-term investors who are trying to simply track the price of natural gas.

Long-Term Investors Should Go With Alternatives

One natural gas fund that has done very well is ProShares UltraShort Bloomberg Natural Gas (KOLD), which provides two times the inverse, or -2x, the daily performance of the same natural gas sub-index as BOIL. The fund is up 114.9% by market price in 2023 as of Nov. 14, but it suffers from the same daily compounding problem and contract-rollover issue as BOIL and UNG.

Rather than invest in futures-based natural gas ETFs, buy-and-hold investors are better off with stocks of natural gas producers. One of the top natural gas companies is Cheniere Energy Inc. (LNG), which operates liquefied natural gas terminals and is the biggest U.S. exporter of that commodity. The company has facilities in Louisiana and Texas and has one of the largest liquefaction platforms in the world. It says it is pursuing liquefaction expansion opportunities.

Research on Natural Gas ETFs Is Crucial

Whether investing in natural gas stocks or ETFs, perhaps the biggest lesson for investors is to do their homework. “Many investors confuse what levered funds actually do, from the structure to the underlying derivatives,” says Daniel Bustamante, managing partner and chief investment officer of asset manager Bustamante Capital. “I think it’s important for any investor to genuinely understand the ETF, leveraged or not, that they are trading because expectations are not always reality.”

Boil Stock vs Uber Stock: Uber Technologies is a technology provider that matches riders with drivers hungry people restaurants food delivery service providers and shippers with carriers. The firm on-demand technology platform could eventually be used for additional products and services such as autonomous vehicle delivery via drones and Uber Elevate which as the firm refers to it provides aerial ride-sharing.

Boil Stock Forecast 2025, Frequently Asked Questions (FAQs)

What is Boil stock?

Boil stock is the stock of Teucrium Natural Gas Fund (NAGS), an exchange-traded fund (ETF) designed to track the performance of natural gas futures contracts. It offers investors exposure to the price movements of natural gas.

How does Boil stock work?

Boil aims to reflect the daily percentage changes in the price of natural gas futures. It does this by holding futures contracts on natural gas and rolling them over periodically.

What is the goal of investing in Boil stock?

Investors in Boil seek to profit from changes in the price of natural gas. They may want to speculate on natural gas price movements or hedge against potential price fluctuations.

Are there risks associated with investing in Boil stock?

Yes, like all investments, Boil comes with risks. Natural gas prices can be highly volatile, which can lead to significant price swings in the ETF. Additionally, Boil may not perfectly track the performance of natural gas due to factors like contango or backwardation.

How do I invest in Boil stock?

To invest in Boil, you’ll need a brokerage account. You can buy shares of the ETF through your brokerage, similar to how you buy shares of individual stocks.

What are the tax implications of investing in Boil stock?

Taxation of gains and losses from Boil stock can vary depending on your country of residence. It’s advisable to consult a tax advisor or accountant to understand the specific tax implications.

Can I hold Boil stock for the long term?

While some investors use Boil for short-term trading or hedging, others may hold it as part of a diversified portfolio. Your investment horizon and risk tolerance should guide your decision.

Are there alternatives to Boil for investing in natural gas?

Yes, besides Boil, investors can consider other natural gas-focused ETFs or mutual funds. Additionally, some investors choose to invest directly in natural gas futures contracts or natural gas-related stocks.

Yes, ProShares Ultra Bloomberg Natural Gas is a publicly traded company.

The ProShares Ultra Bloomberg Natural Gas stock price is 45.43 USD today.

You can buy ProShares Ultra Bloomberg Natural Gas shares by opening an account at a top-tier brokerage firm, such as TD Ameritrade or tastyworks.

What is the prediction for the BOIL stock price?

On corrections up, there will be some resistance from the lines at $50.36 and $60.56. A break-up above any of these levels will issue buy signals. A sell signal was issued from a pivot top point on Tuesday, October 31, 2023, and so far it has fallen -34.03%.